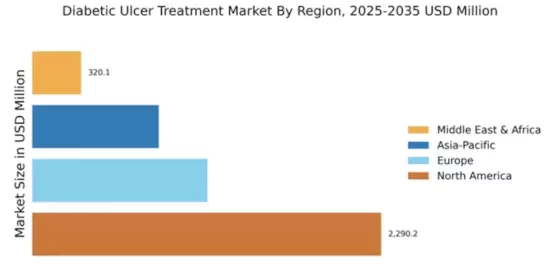

North America : Market Leader in Treatment

North America is poised to maintain its leadership in the Diabetic Ulcer Treatment Market, holding a significant market size of $2290.2M. Key growth drivers include an increasing prevalence of diabetes, advancements in wound care technologies, and supportive healthcare policies. The region's robust healthcare infrastructure and rising awareness about diabetic complications further fuel demand for effective treatment solutions.

The United States stands out as the leading country, with major players like Smith & Nephew, Acelity, and Medtronic driving innovation and market growth. The competitive landscape is characterized by strategic partnerships and product launches aimed at enhancing treatment efficacy. As the market evolves, the focus on patient-centric solutions and advanced wound care products will likely shape the future of diabetic ulcer management.

Europe : Emerging Market Dynamics

Europe's Diabetic Ulcer Treatment Market is projected to reach $1150.1M, driven by an aging population and increasing diabetes cases. Regulatory support for advanced wound care products and a growing emphasis on preventive healthcare are key factors propelling market growth. The region's healthcare systems are increasingly adopting innovative treatment modalities, enhancing patient outcomes and satisfaction.

Leading countries such as Germany, France, and the UK are at the forefront of this market, with significant contributions from companies like Mölnlycke Health Care and ConvaTec. The competitive landscape is marked by a mix of established players and emerging startups, focusing on research and development to introduce novel therapies. As the market matures, collaboration between healthcare providers and manufacturers will be crucial for addressing the rising demand for effective diabetic ulcer treatments.

Asia-Pacific : Rapidly Growing Market

The Asia-Pacific Diabetic Ulcer Treatment Market is estimated at $830.0M, reflecting a growing awareness of diabetes management and wound care. Factors such as increasing healthcare expenditure, rising diabetes prevalence, and government initiatives to improve healthcare access are driving market growth. The region is witnessing a shift towards advanced treatment options, including bioengineered products and smart wound dressings.

Countries like China, India, and Japan are leading the market, with significant investments from key players such as 3M and B. Braun Melsungen AG. The competitive landscape is evolving, with local manufacturers emerging alongside global giants, enhancing the availability of diverse treatment options. As the market develops, the focus on affordability and accessibility will be essential for meeting the needs of the growing diabetic population.

Middle East and Africa : Untapped Market Potential

The Middle East and Africa Diabetic Ulcer Treatment Market is valued at $320.11M, with significant growth potential driven by increasing diabetes rates and a rising awareness of wound care. The region faces challenges such as limited healthcare infrastructure and access to advanced treatment options, but ongoing investments in healthcare are expected to improve the situation. Government initiatives aimed at enhancing healthcare services are also contributing to market growth.

Countries like South Africa and the UAE are leading the market, with a growing presence of international players like Hollister and KCI Medical. The competitive landscape is characterized by a mix of local and global companies, focusing on innovative solutions to address the unique challenges of diabetic ulcer treatment in the region. As healthcare systems evolve, the demand for effective and affordable treatment options will likely increase.