Increased Healthcare Expenditure

The rising healthcare expenditure in the US is a significant driver for the osteosynthesis implants market. With healthcare spending projected to reach approximately $4.1 trillion by 2025, there is a growing investment in advanced medical technologies, including osteosynthesis implants. This increase in funding allows for the development and adoption of innovative implant solutions that improve patient outcomes. Furthermore, as healthcare policies evolve to emphasize quality care and patient safety, hospitals and surgical centers are more inclined to invest in high-quality implants. This trend is likely to bolster the osteosynthesis implants market, as healthcare providers seek to enhance their service offerings and meet the demands of an increasingly health-conscious population.

Growing Demand for Sports Medicine

The rising interest in sports and physical activities among the US population is driving demand for osteosynthesis implants. As more individuals engage in sports, the incidence of sports-related injuries, such as fractures and ligament tears, is increasing. This trend is particularly evident among younger demographics, who are more active and prone to injuries. The osteosynthesis implants market is likely to benefit from this growing demand, as athletes and active individuals seek effective solutions for injury repair and recovery. Additionally, advancements in minimally invasive surgical techniques are making it easier for athletes to return to their activities more quickly, further fueling market growth. The sports medicine sector is expected to continue expanding, contributing positively to the overall osteosynthesis implants market.

Rising Incidence of Orthopedic Disorders

The increasing prevalence of orthopedic disorders in the US is a primary driver for the osteosynthesis implants market. Conditions such as fractures, osteoporosis, and degenerative joint diseases are becoming more common, particularly among the aging population. According to recent data, approximately 1.5 million fractures occur annually in the US, necessitating surgical intervention and the use of osteosynthesis implants. This growing patient demographic is likely to propel demand for innovative and effective implant solutions, thereby expanding the market. Furthermore, advancements in surgical techniques and materials are enhancing the efficacy of these implants, making them a preferred choice for orthopedic surgeons. As the population ages, the osteosynthesis implants market is expected to witness sustained growth, driven by the need for effective treatment options for these prevalent conditions.

Technological Innovations in Implant Design

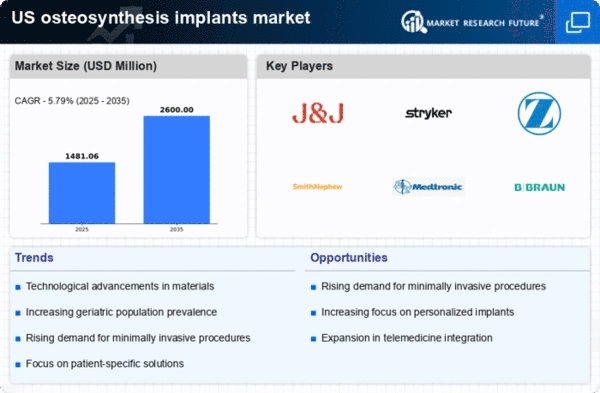

Technological advancements in implant design are significantly influencing the osteosynthesis implants market. Innovations such as bioresorbable materials, 3D printing, and enhanced imaging techniques are revolutionizing the way implants are developed and utilized. For instance, the introduction of 3D-printed implants allows for customized solutions tailored to individual patient anatomies, improving surgical outcomes. Additionally, the integration of smart technologies into implants, such as sensors for monitoring healing, is gaining traction. These innovations not only enhance the performance of osteosynthesis implants but also reduce recovery times and improve patient satisfaction. The market is projected to grow as these technologies become more widely adopted, with estimates suggesting a compound annual growth rate (CAGR) of around 7% over the next five years.

Aging Population and Increased Surgical Procedures

The aging population in the US is a crucial driver for the osteosynthesis implants market. As individuals age, they are more susceptible to fractures and other orthopedic issues, leading to an increase in surgical procedures involving osteosynthesis implants. Data indicates that individuals aged 65 and older account for a significant portion of orthopedic surgeries, with projections suggesting that this demographic will continue to grow. This trend is likely to result in a higher demand for osteosynthesis implants, as healthcare providers seek to address the needs of an aging population. Furthermore, advancements in surgical techniques and implant materials are enhancing the safety and effectiveness of these procedures, making them more appealing to both patients and surgeons. The osteosynthesis implants market is expected to thrive as the demand for surgical interventions rises.