Surge in Sports Activities

The surge in sports activities among the German population is contributing to the growth of the osteosynthesis implants market. As more individuals engage in recreational and competitive sports, the incidence of sports-related injuries, including fractures, is on the rise. This trend necessitates the use of osteosynthesis implants for effective treatment and rehabilitation. The market is projected to grow by approximately 5% annually, driven by the increasing demand for surgical interventions following sports injuries. The osteosynthesis implants market must respond to this growing need by providing innovative solutions tailored to the specific requirements of athletes and active individuals. This focus on sports-related injuries may lead to the development of specialized implants designed for enhanced performance and recovery.

Increased Healthcare Expenditure

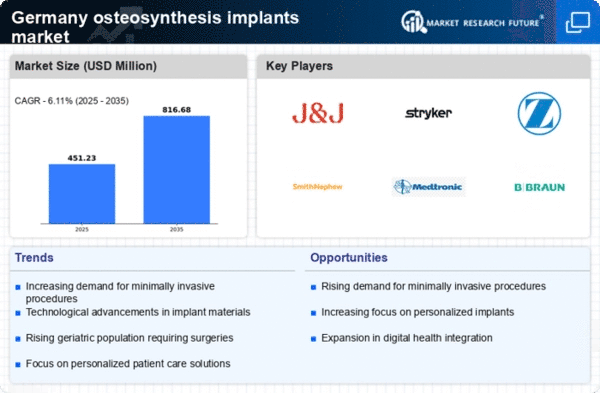

Germany's rising healthcare expenditure is a crucial driver for the osteosynthesis implants market. With healthcare spending reaching approximately €400 billion in recent years, there is a growing focus on improving surgical outcomes and patient care. This financial commitment enables hospitals and clinics to invest in advanced surgical technologies and high-quality implants. The osteosynthesis implants market stands to benefit from this trend, as healthcare providers seek to enhance their offerings and improve patient satisfaction. Furthermore, the German government has implemented policies aimed at increasing access to innovative medical technologies, which may further stimulate market growth. As a result, the market is expected to expand at a compound annual growth rate (CAGR) of around 4% over the next few years.

Advancements in Implant Materials

Innovations in implant materials are significantly influencing the osteosynthesis implants market. The introduction of biocompatible materials, such as titanium alloys and bioactive ceramics, enhances the performance and longevity of implants. These advancements not only improve patient outcomes but also reduce the risk of complications, thereby increasing the adoption of these implants in surgical procedures. The market is projected to witness a growth rate of approximately 5% annually, driven by the demand for high-quality materials that ensure better integration with bone tissue. As the osteosynthesis implants market continues to evolve, manufacturers are likely to invest in research and development to create next-generation materials that meet the stringent requirements of healthcare providers.

Rising Incidence of Bone Fractures

The increasing incidence of bone fractures in Germany is a primary driver for the osteosynthesis implants market. Factors such as an aging population and a rise in sports-related injuries contribute to this trend. According to recent statistics, approximately 1.5 million fractures occur annually in Germany, with a significant portion requiring surgical intervention. This growing demand for surgical solutions is likely to propel the market forward. As the population ages, the need for effective osteosynthesis solutions becomes more pronounced, leading to an anticipated growth rate of around 6% in the market over the next few years. The osteosynthesis implants market must adapt to these changing demographics to meet the increasing demand for innovative and effective treatment options.

Growing Awareness of Orthopedic Health

There is a growing awareness of orthopedic health among the German population, which is positively impacting the osteosynthesis implants market. Educational campaigns and increased access to information about bone health have led to more individuals seeking medical advice for orthopedic issues. This heightened awareness encourages early diagnosis and treatment, resulting in a higher demand for surgical interventions involving osteosynthesis implants. The market is expected to experience a growth rate of around 4% as healthcare providers respond to this trend by offering comprehensive orthopedic services. The osteosynthesis implants market must capitalize on this increased awareness by promoting the benefits of timely intervention and the availability of advanced implant technologies.