Growing Awareness of Bone Health

There is a notable increase in public awareness regarding bone health and the importance of timely treatment for fractures and orthopedic conditions. Campaigns promoting bone health and injury prevention are becoming more prevalent in Italy, which is likely to influence the osteosynthesis implants market positively. As individuals become more informed about the risks associated with untreated fractures, the demand for surgical interventions is expected to rise. This heightened awareness may lead to an increase in consultations with orthopedic specialists, thereby driving the need for osteosynthesis implants. The market could see a growth rate of around 10% as more patients seek surgical solutions for their bone health issues.

Rising Incidence of Sports Injuries

The increasing participation in sports and physical activities among the Italian population is contributing to a rise in sports-related injuries, thereby driving the osteosynthesis implants market. As more individuals engage in recreational and competitive sports, the incidence of fractures and orthopedic injuries is likely to increase. This trend is particularly evident among younger demographics, who are more prone to injuries. In 2025, it is projected that sports injuries will account for a significant portion of orthopedic surgeries, leading to a higher demand for osteosynthesis implants. Consequently, healthcare providers are expected to adapt their services to accommodate this growing need, further propelling the market forward.

Technological Innovations in Implant Design

Innovations in the design and materials used for osteosynthesis implants are significantly impacting the market in Italy. The introduction of bioresorbable implants and advanced materials that promote faster healing is attracting attention from both surgeons and patients. These innovations not only enhance the effectiveness of surgical procedures but also reduce the risk of complications associated with traditional implants. As a result, the osteosynthesis implants market is likely to benefit from a growing preference for these advanced solutions. In 2025, it is estimated that the market share of innovative implant designs could account for approximately 20% of total sales, reflecting a shift towards more effective and patient-friendly options.

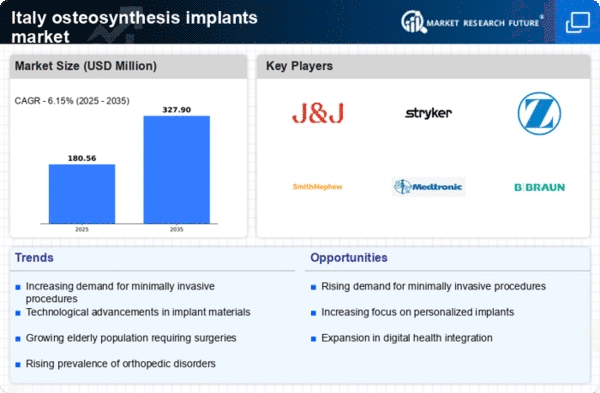

Rising Demand for Minimally Invasive Procedures

The increasing preference for minimally invasive surgical techniques is driving the osteosynthesis implants market in Italy. These procedures are associated with reduced recovery times, lower risk of complications, and less postoperative pain. As a result, healthcare providers are increasingly adopting these techniques, leading to a higher demand for specialized implants. In 2025, the market for minimally invasive surgeries is projected to grow by approximately 15%, which directly influences the osteosynthesis implants market. This trend is further supported by advancements in surgical technologies, which enhance the effectiveness of these procedures. Consequently, the osteosynthesis implants market is likely to experience significant growth as more hospitals and surgical centers invest in the necessary equipment and training to facilitate these innovative approaches.

Increased Investment in Healthcare Infrastructure

Italy's ongoing investment in healthcare infrastructure is a crucial driver for the osteosynthesis implants market. The government has allocated substantial funds to modernize hospitals and surgical facilities, which enhances the capacity to perform complex orthopedic surgeries. This investment is expected to reach €5 billion by 2026, thereby improving access to advanced medical technologies and treatments. As healthcare facilities upgrade their equipment and expand their services, the demand for osteosynthesis implants is likely to rise. Furthermore, the establishment of specialized orthopedic centers is anticipated to contribute to the growth of the market, as these centers often require a higher volume of implants to meet patient needs.