Emergence of Autonomous Vehicles

The rise of autonomous vehicles is a transformative factor in the US Navigation Satellite System Market. As manufacturers and technology companies invest heavily in developing self-driving cars, the demand for reliable navigation systems is intensifying. These vehicles require precise positioning data to operate safely and efficiently, which in turn drives innovation within the navigation satellite sector. The market for autonomous vehicles is expected to reach USD 60 billion by 2030, with navigation systems playing a critical role in their functionality. This trend indicates a significant opportunity for growth within the US Navigation Satellite System Market, as companies strive to meet the evolving needs of this burgeoning sector.

Expansion of Commercial Applications

The US Navigation Satellite System Market is witnessing an expansion of commercial applications, which is driving market growth. Industries such as logistics, agriculture, and telecommunications are increasingly adopting satellite navigation technologies to enhance operational efficiency. For instance, logistics companies are utilizing GPS tracking systems to optimize delivery routes, resulting in reduced fuel consumption and improved customer satisfaction. The agricultural sector is also leveraging satellite navigation for precision farming, which enhances crop yields and reduces waste. This diversification of applications is expected to contribute to a market growth rate of approximately 7% annually over the next five years, highlighting the potential of the US Navigation Satellite System Market.

Increased Focus on National Security

National security concerns are increasingly influencing the US Navigation Satellite System Market. The government recognizes the strategic importance of satellite navigation for military operations and homeland security. As a result, there is a growing emphasis on enhancing the resilience and security of navigation systems against potential threats, including cyberattacks and signal jamming. The Department of Defense is investing in next-generation satellite systems that offer improved security features, which is expected to drive market growth. This focus on national security not only ensures the reliability of navigation systems but also positions the US Navigation Satellite System Market as a critical component of national defense strategy.

Government Investment in Infrastructure

The US Navigation Satellite System Market is bolstered by substantial government investment in infrastructure development. Federal initiatives aimed at modernizing transportation networks and enhancing public safety are driving the need for advanced navigation systems. The Federal Aviation Administration (FAA) has allocated significant funding for the integration of satellite-based navigation in air traffic management, which is expected to improve efficiency and safety in the aviation sector. Additionally, the Department of Transportation is promoting the use of satellite navigation in smart city projects, further expanding the market. This government support not only stimulates growth but also encourages private sector participation in the US Navigation Satellite System Market.

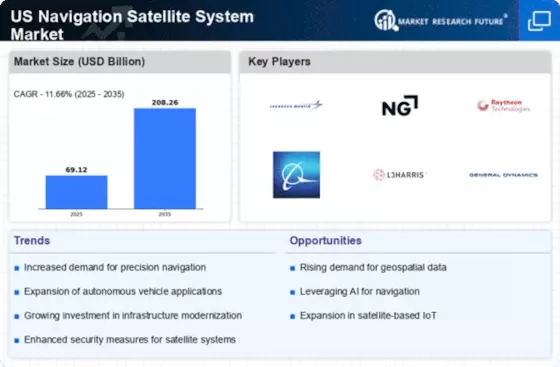

Growing Demand for Precision Navigation

The US Navigation Satellite System Market is experiencing a notable surge in demand for precision navigation solutions. This growth is largely driven by the increasing reliance on accurate positioning data across various sectors, including transportation, agriculture, and logistics. According to recent data, the market for precision navigation systems is projected to reach USD 10 billion by 2027, reflecting a compound annual growth rate of approximately 8%. This demand is further fueled by advancements in satellite technology, which enhance the accuracy and reliability of navigation systems. As industries seek to optimize operations and improve safety, the US Navigation Satellite System Market is poised to benefit significantly from this trend.