Growth of the Wellness Industry

The wellness industry is experiencing robust growth, which is positively impacting the nap capsules market. As consumers increasingly prioritize holistic health and self-care, products that facilitate relaxation and rejuvenation are gaining traction. The wellness market in the US is projected to reach $1.5 trillion by 2025, indicating a substantial opportunity for the nap capsules market. This growth is fueled by a rising interest in natural and non-pharmaceutical solutions for stress relief and sleep enhancement. Consequently, manufacturers are likely to innovate and diversify their offerings to cater to this expanding consumer base, further driving the demand for nap capsules.

Rising Interest in Functional Foods

The rising interest in functional foods is contributing to the growth of the nap capsules market. Consumers are increasingly seeking products that offer health benefits beyond basic nutrition, including those that promote better sleep. The functional food market in the US is expected to reach $275 billion by 2025, indicating a significant opportunity for the nap capsules market. As manufacturers explore innovative formulations that combine sleep-enhancing ingredients with convenience, the appeal of nap capsules is likely to expand. This trend reflects a broader consumer shift towards products that support overall health and well-being.

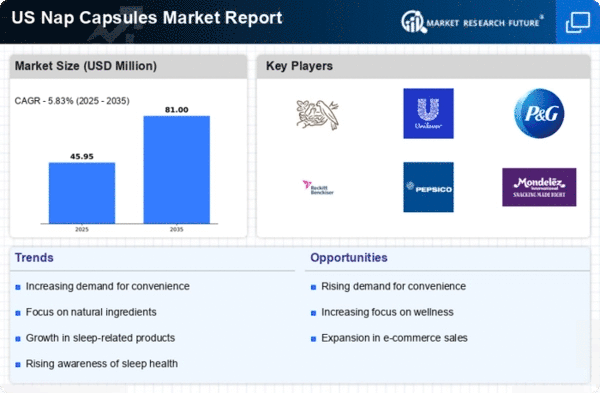

Increasing Awareness of Sleep Health

The growing recognition of the importance of sleep health is driving the nap capsules market. As individuals become more aware of the detrimental effects of sleep deprivation on overall well-being, there is a noticeable shift towards products that promote better sleep quality. This trend is particularly evident among working professionals and students who often experience fatigue due to demanding schedules. According to recent surveys, approximately 30% of adults report feeling tired during the day, which has led to an increased interest in nap capsules as a quick solution. The nap capsules market is likely to benefit from this heightened awareness, as consumers seek effective ways to enhance their productivity and mental clarity through improved rest.

Shift Towards Flexible Work Arrangements

The shift towards flexible work arrangements, including remote and hybrid models, is influencing the nap capsules market. As employees adapt to new work environments, many are seeking ways to optimize their productivity and manage fatigue. The ability to take short naps during the day has become increasingly appealing, particularly for those working from home. Research indicates that 20% of remote workers report using nap breaks to enhance focus and creativity. This trend suggests that the nap capsules market may see a surge in demand as more individuals recognize the benefits of incorporating short rest periods into their daily routines.

Technological Advancements in Product Development

Technological advancements in product development are shaping the nap capsules market. Innovations in formulation and delivery methods are enabling manufacturers to create more effective and appealing products. For instance, the integration of smart technology in nap capsules, such as sleep tracking and personalized recommendations, is becoming more prevalent. This evolution is likely to attract tech-savvy consumers who are interested in optimizing their rest. The nap capsules market may experience increased competition as brands leverage technology to differentiate their offerings and enhance consumer engagement.