Escalating Defense Budgets

The military robots market is experiencing a surge in demand due to escalating defense budgets across the United States. In recent years, the U.S. government has allocated substantial funds to enhance military capabilities, with a focus on advanced technologies. For instance, the Department of Defense's budget for 2025 is projected to exceed $800 billion, with a significant portion earmarked for modernization initiatives. This financial commitment is likely to drive investments in military robots, as they are seen as essential for maintaining strategic advantages. The military robots market is poised to benefit from this trend, as increased funding allows for the development and procurement of sophisticated robotic systems that can perform a variety of tasks, from surveillance to combat support.

Rising Geopolitical Tensions

Rising geopolitical tensions are a critical driver for the military robots market. As nations face increasing threats from adversaries, the need for advanced military solutions becomes paramount. The U.S. has been actively involved in various international conflicts and has heightened its focus on deterrence strategies. This environment creates a pressing demand for military robots that can operate in high-risk scenarios, providing intelligence, surveillance, and reconnaissance capabilities. The military robots market is likely to see growth as defense contractors respond to these challenges by developing innovative robotic systems that enhance operational effectiveness and reduce human risk in combat situations.

Growing Demand for Unmanned Systems

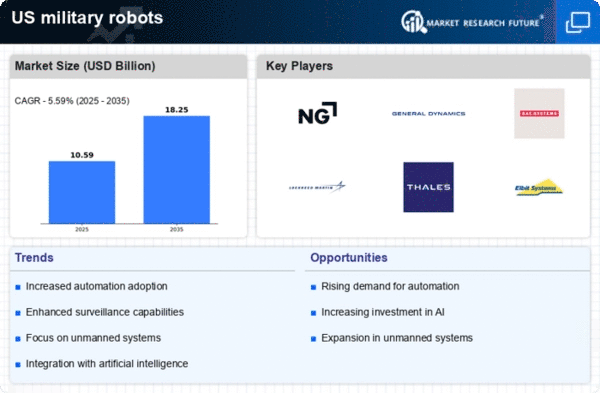

The growing demand for unmanned systems is a pivotal factor driving the military robots market. Unmanned aerial vehicles (UAVs) and ground robots are increasingly utilized for various military applications, including reconnaissance, logistics, and combat support. The U.S. military has recognized the strategic advantages of deploying unmanned systems, which can operate in environments that are too dangerous for human personnel. This trend is reflected in the military robots market, where the demand for such systems is projected to grow at a CAGR of over 10% through the next decade. As military operations evolve, the reliance on unmanned systems is likely to intensify, further propelling market growth.

Focus on Force Protection and Safety

The focus on force protection and safety is a significant driver for the military robots market. As military operations become increasingly complex, ensuring the safety of personnel is paramount. Military robots are being developed to perform high-risk tasks, such as bomb disposal and reconnaissance in hostile environments, thereby reducing the risk to human soldiers. The military robots market is likely to see increased investment in systems designed specifically for force protection, as the U.S. military prioritizes the safety of its personnel. This emphasis on safety not only enhances operational effectiveness but also aligns with broader defense strategies aimed at minimizing casualties in combat.

Technological Advancements in Robotics

Technological advancements in robotics are significantly influencing the military robots market. Innovations in areas such as artificial intelligence, machine learning, and sensor technology are enabling the development of more capable and versatile military robots. For example, the integration of AI allows for improved decision-making and autonomous operations, which are crucial for modern warfare. The military robots market is expected to expand as these technologies become more sophisticated and affordable, leading to increased adoption by military forces. The U.S. military is actively pursuing these advancements, with initiatives aimed at integrating cutting-edge robotics into their operational frameworks.