Increased Focus on Cybersecurity

As military robotics-autonomous-systems become more integrated into defense operations, the focus on cybersecurity has intensified. The potential vulnerabilities associated with autonomous systems pose significant risks, prompting military organizations to invest heavily in cybersecurity measures. This trend is reflected in the allocation of approximately $1.5 billion in 2025 for cybersecurity initiatives related to military technologies. Ensuring the integrity and security of autonomous systems is crucial for maintaining operational effectiveness and safeguarding sensitive information. Consequently, the military robotics-autonomous-systems market is likely to experience an increase in demand for secure and resilient systems that can withstand cyber threats.

Advancements in Sensor Technology

The military robotics-autonomous-systems market is experiencing a surge in advancements in sensor technology, which enhances the capabilities of unmanned systems. These innovations allow for improved situational awareness, enabling military personnel to make informed decisions in real-time. For instance, the integration of advanced imaging systems and LIDAR technology has been pivotal in reconnaissance missions. The market is projected to grow at a CAGR of 10.5% from 2025 to 2030, driven by the demand for more sophisticated sensors that can operate in diverse environments. As military operations become increasingly complex, the need for reliable and accurate data collection through advanced sensors is paramount, thereby propelling the growth of the military robotics-autonomous-systems market.

Rising Demand for Unmanned Systems

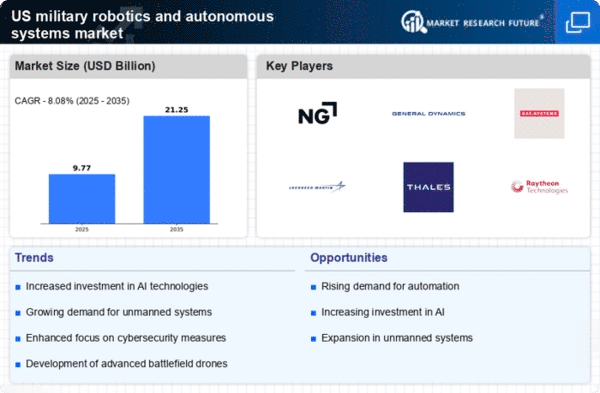

The military robotics-autonomous-systems market is witnessing a rising demand for unmanned systems, including aerial, ground, and underwater vehicles. This trend is largely driven by the need for enhanced operational efficiency and reduced risk to human life. According to recent estimates, the market for unmanned aerial vehicles (UAVs) alone is expected to reach $10 billion by 2026. The increasing adoption of these systems for surveillance, logistics, and combat roles indicates a shift in military strategy towards automation. As defense budgets continue to allocate funds towards unmanned technologies, the military robotics-autonomous-systems market is likely to expand significantly, reflecting a broader trend towards automation in military operations.

Strategic Partnerships and Collaborations

Strategic partnerships and collaborations among defense contractors, technology firms, and research institutions are shaping the military robotics-autonomous-systems market. These alliances facilitate the sharing of expertise and resources, leading to accelerated innovation and development of cutting-edge technologies. For example, partnerships between traditional defense contractors and tech startups have resulted in the rapid advancement of AI and machine learning applications in military robotics. Such collaborations are expected to enhance the capabilities of autonomous systems, making them more effective in various military applications. The military robotics-autonomous-systems market is likely to benefit from these synergies, as they foster a more dynamic and responsive development environment.

Growing Emphasis on Training and Simulation

The military robotics-autonomous-systems market is increasingly emphasizing training and simulation technologies to prepare personnel for operating advanced autonomous systems. As these technologies become more prevalent, effective training programs are essential to ensure that military personnel can utilize them efficiently. Investments in simulation technologies are projected to reach $2 billion by 2027, reflecting the military's commitment to enhancing operational readiness. By providing realistic training environments, military organizations can better equip their personnel to handle the complexities of autonomous systems. This focus on training is likely to drive growth in the military robotics-autonomous-systems market, as it ensures that personnel are well-prepared for future challenges.

.png)