Rising Defense Budgets

The Military Robotics and Autonomous Systems Market is experiencing a notable surge in defense budgets across various nations. Governments are increasingly allocating substantial financial resources to enhance their military capabilities, which includes investing in advanced robotics and autonomous systems. For instance, defense budgets in several countries have seen an increase of approximately 5-10% annually, reflecting a strategic shift towards modernization. This trend is driven by the need for improved operational efficiency and effectiveness in military operations. As nations prioritize technological advancements, the demand for military robotics and autonomous systems is likely to escalate, fostering innovation and competition within the industry.

Collaborative Defense Initiatives

Collaborative defense initiatives among allied nations are emerging as a crucial driver for the Military Robotics and Autonomous Systems Market. Joint military exercises and partnerships are fostering the development and integration of advanced robotic systems. These collaborations enable countries to share technological advancements and best practices, thereby accelerating innovation in military robotics. For instance, multinational programs aimed at developing autonomous systems for joint operations are gaining traction, with funding and resources pooled from participating nations. This collaborative approach not only enhances interoperability but also stimulates market growth as nations seek to leverage shared capabilities in an increasingly complex security landscape.

Increased Demand for Unmanned Systems

The Military Robotics and Autonomous Systems Market is witnessing a marked increase in demand for unmanned systems. This trend is driven by the advantages these systems offer, such as reduced risk to human life and enhanced operational efficiency. Unmanned aerial vehicles (UAVs), ground robots, and naval drones are increasingly being deployed for various military applications, including surveillance, logistics, and combat support. Market analysis indicates that the UAV segment alone is expected to account for a substantial share of the market, with projections suggesting a growth rate of over 12% in the coming years. This growing reliance on unmanned systems underscores a transformative shift in military strategy and operations.

Technological Advancements in Robotics

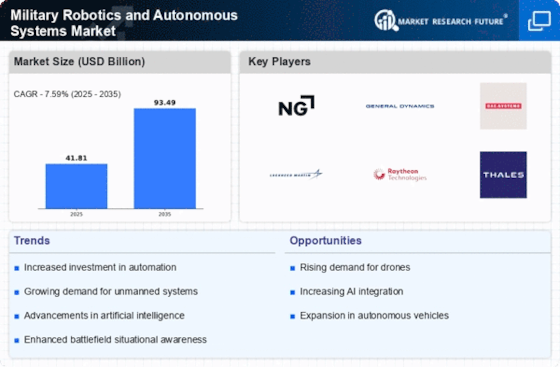

Technological advancements play a pivotal role in shaping the Military Robotics and Autonomous Systems Market. Innovations in robotics, such as enhanced sensors, improved mobility, and advanced artificial intelligence, are revolutionizing military operations. The integration of these technologies enables the development of sophisticated unmanned systems capable of performing complex tasks in diverse environments. For example, the market for military drones is projected to grow significantly, with estimates suggesting a compound annual growth rate of around 15% over the next five years. This growth is indicative of the increasing reliance on autonomous systems for surveillance, reconnaissance, and combat missions, thereby driving the overall market.

Geopolitical Tensions and Security Concerns

Geopolitical tensions and security concerns are significant drivers of the Military Robotics and Autonomous Systems Market. As nations face evolving threats, including terrorism and cyber warfare, there is a pressing need for advanced military solutions. Countries are investing in robotics and autonomous systems to enhance their defense capabilities and ensure national security. The rise in regional conflicts and the need for rapid response mechanisms have led to an increased focus on unmanned systems for intelligence gathering and combat operations. This heightened emphasis on security is likely to propel the demand for military robotics, as nations seek to maintain a strategic advantage over potential adversaries.