Growing Consumer Awareness

The mezcal market is experiencing a notable increase in consumer awareness regarding the unique characteristics and production methods of mezcal. As consumers become more educated about the differences between mezcal and tequila, they are increasingly seeking authentic and artisanal products. This trend is reflected in the rising demand for premium mezcal brands, which has seen a growth rate of approximately 15% annually in the US. The emphasis on quality and craftsmanship is driving consumers to explore various mezcal offerings, thereby expanding the market. Additionally, social media platforms play a crucial role in promoting mezcal culture, further enhancing consumer interest and engagement. This heightened awareness is likely to continue influencing purchasing decisions, thereby propelling the mezcal market forward.

Influence of Mixology Trends

The mezcal market is significantly influenced by evolving mixology trends, as bartenders and mixologists increasingly incorporate mezcal into innovative cocktail recipes. This trend is indicative of a broader movement towards craft cocktails, where unique and high-quality ingredients are prioritized. The versatility of mezcal, with its distinct smoky flavor profile, allows it to be used in a variety of drinks, appealing to adventurous consumers. Recent surveys indicate that cocktails featuring mezcal have seen a rise in popularity, with a reported increase of 30% in mezcal-based cocktail orders in upscale bars. This trend not only enhances the visibility of mezcal but also encourages consumers to experiment with different brands and styles, thereby driving growth in the mezcal market.

Cultural Events and Festivals

Cultural events and festivals celebrating mezcal are playing a crucial role in promoting the mezcal market in the US. These events not only educate consumers about mezcal's rich heritage but also provide opportunities for tasting and experiencing various brands. Festivals dedicated to mezcal have seen increased attendance, with some events reporting a 40% rise in participation over the past few years. Such gatherings foster a sense of community among mezcal enthusiasts and create a platform for producers to showcase their offerings. The growing popularity of these cultural events is likely to enhance consumer engagement and interest in mezcal, thereby contributing to the overall growth of the mezcal market.

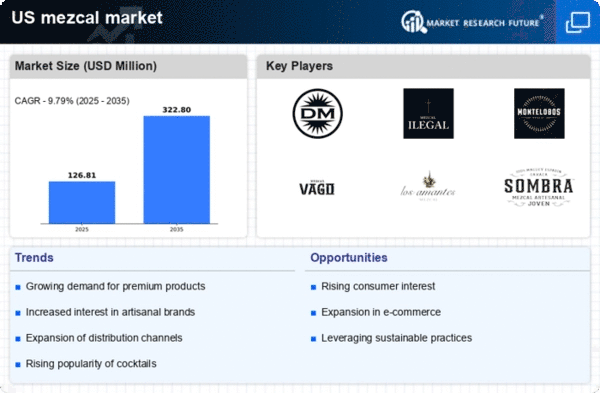

Expansion of Distribution Channels

The mezcal market is benefiting from the expansion of distribution channels across the US. Retailers are increasingly recognizing the potential of mezcal as a premium spirit, leading to its inclusion in a wider array of outlets, including specialty liquor stores, bars, and restaurants. This diversification in distribution is crucial, as it allows consumers greater access to mezcal products, which may have previously been limited to niche markets. According to recent data, the number of mezcal brands available in the US has increased by over 20% in the past year, indicating a robust growth trajectory. Furthermore, online sales platforms are also contributing to this expansion, enabling consumers to purchase mezcal directly from producers. This increased availability is likely to enhance brand visibility and consumer choice, thereby stimulating growth in the mezcal market.

Sustainability and Organic Production

Sustainability is becoming a pivotal driver in the mezcal market, as consumers increasingly prioritize environmentally friendly and organic products. Many mezcal producers are adopting sustainable farming practices, which resonate with the growing demographic of eco-conscious consumers. This shift towards organic production is not only beneficial for the environment but also enhances the appeal of mezcal as a premium product. Data suggests that organic mezcal sales have surged by approximately 25% in the past year, reflecting a strong consumer preference for sustainably produced spirits. As more brands commit to sustainable practices, the mezcal market is likely to see continued growth, as consumers align their purchasing decisions with their values.