Innovative Marketing Strategies

The mezcal Market is benefiting from innovative marketing strategies that resonate with contemporary consumers. Brands are increasingly leveraging social media, experiential marketing, and storytelling to connect with their audience. This approach not only enhances brand visibility but also fosters a sense of community among mezcal enthusiasts. Market data suggests that brands employing creative marketing tactics experience higher engagement rates and customer loyalty. By effectively communicating their unique selling propositions and engaging consumers through interactive experiences, mezcal brands are able to differentiate themselves in a crowded marketplace. This trend towards innovative marketing is likely to continue shaping the Mezcal Market, as brands strive to capture the attention of discerning consumers.

Cultural Heritage and Authenticity

The Mezcal Market is profoundly influenced by the cultural heritage associated with mezcal production. As consumers become more aware of the historical and cultural significance of mezcal, there is a growing demand for authentic products that reflect traditional production methods. This cultural connection enhances the appeal of mezcal, as consumers are drawn to brands that emphasize their roots and authenticity. The market data suggests that brands that successfully communicate their heritage and production techniques tend to perform better in terms of sales. This trend not only supports the preservation of traditional practices but also fosters a deeper appreciation for the craftsmanship involved in mezcal production, thereby enriching the Mezcal Market.

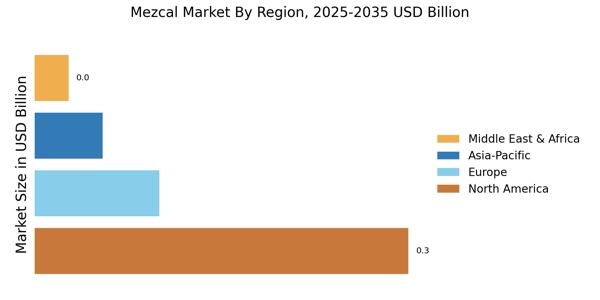

Expansion of Distribution Channels

The Mezcal Market is experiencing an expansion of distribution channels, which plays a crucial role in enhancing accessibility and visibility for mezcal brands. With the rise of e-commerce and online retail platforms, consumers now have greater access to a diverse range of mezcal products. Additionally, traditional retail outlets are increasingly featuring mezcal in their offerings, further broadening its reach. This expansion is supported by market data indicating a steady increase in the number of mezcal brands entering the market, which in turn drives competition and innovation. As distribution channels continue to evolve, the Mezcal Market is likely to see sustained growth, as more consumers discover and engage with mezcal.

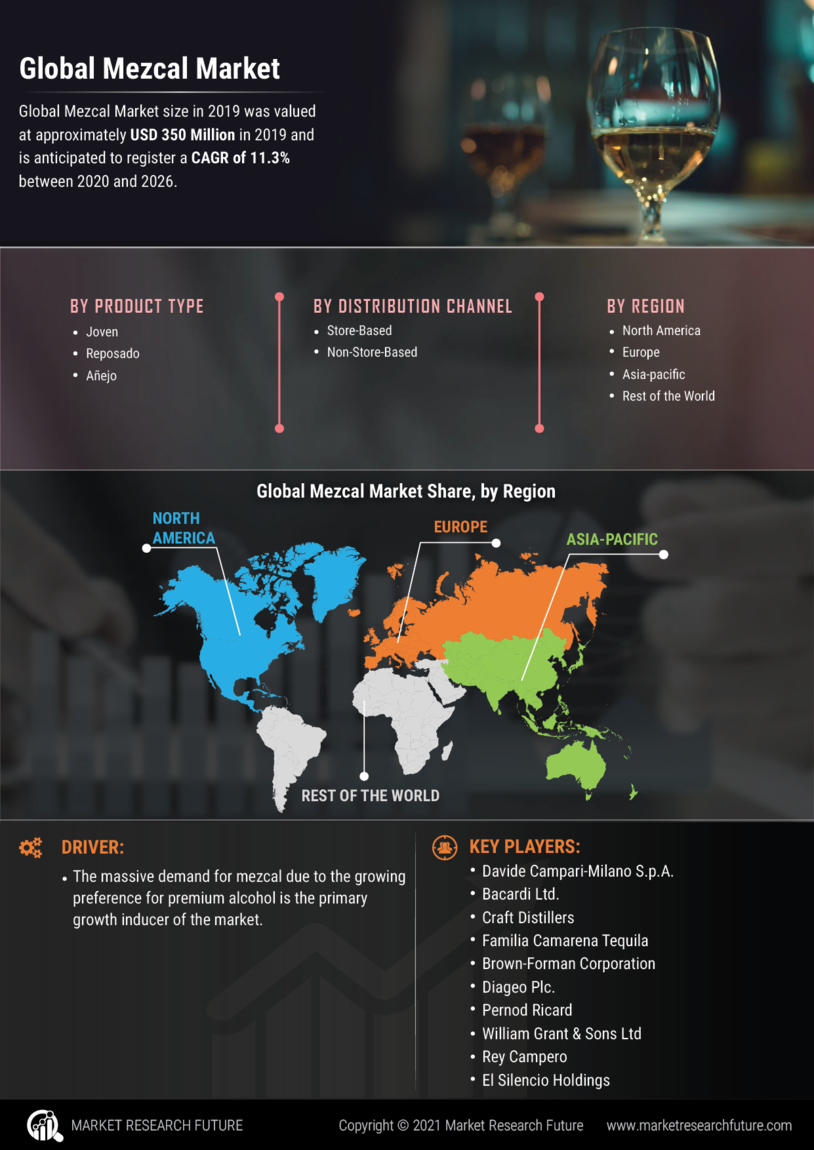

Rising Consumer Interest in Premium Spirits

The Mezcal Market experiences a notable surge in consumer interest towards premium and artisanal spirits. This trend is driven by a growing appreciation for quality over quantity, with consumers increasingly seeking unique and authentic drinking experiences. As a result, the demand for high-quality mezcal has escalated, with sales figures indicating a significant increase in the premium segment. In 2025, the premium mezcal segment is projected to account for a substantial portion of the overall market, reflecting a shift in consumer preferences. This inclination towards premium products not only enhances the market's value but also encourages producers to focus on quality, thereby elevating the overall standards within the Mezcal Market.

Health Consciousness and Natural Ingredients

The Mezcal Market is witnessing a shift towards health-conscious consumption patterns, with consumers increasingly favoring spirits made from natural ingredients. This trend aligns with a broader movement towards wellness and sustainability, as individuals seek beverages that are perceived as healthier alternatives. Mezcal Market, often made from organic agave and without artificial additives, fits well within this paradigm. Market data indicates that the demand for organic and natural spirits is on the rise, with mezcal producers capitalizing on this trend by highlighting their use of pure ingredients. This focus on health and naturalness not only attracts a new demographic of consumers but also positions mezcal as a sophisticated choice within the Mezcal Market.