Rising Demand for Precision Surgery

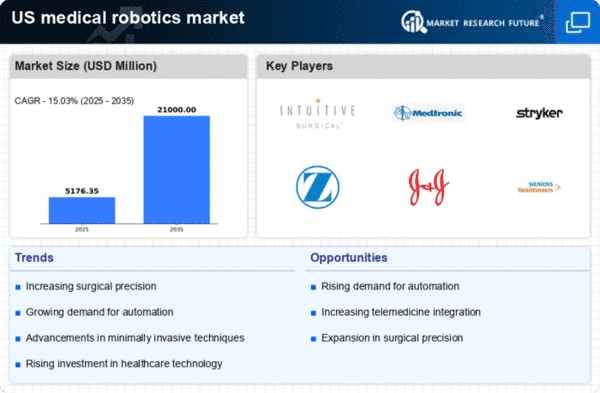

The medical robotics market is experiencing an increase in demand for precision surgical procedures. Surgeons and healthcare providers are increasingly recognizing the benefits of robotic-assisted surgeries, which offer enhanced accuracy and reduced recovery times. This trend is particularly evident in specialties such as orthopedics and urology, where robotic systems demonstrate superior outcomes. According to recent data, the market for surgical robots is projected to reach approximately $12 billion by 2026, reflecting a compound annual growth rate (CAGR) of around 15%. This rising demand is likely to drive innovation and investment in the medical robotics market, as manufacturers strive to develop more advanced and user-friendly robotic systems.

Aging Population and Chronic Diseases

The medical robotics market is significantly influenced by the aging population in the United States, which is leading to an increase in chronic diseases. As individuals age, they often require surgical interventions for conditions such as arthritis, cardiovascular diseases, and cancer. The integration of robotic systems in surgical procedures is becoming essential to address these health challenges effectively. It is estimated that by 2030, nearly 20% of the U.S. population will be over 65 years old, creating a substantial demand for robotic-assisted surgeries. This demographic shift is likely to propel growth in the medical robotics market, as healthcare providers seek to improve surgical outcomes and patient care.

Advancements in Training and Education

Advancements in training and education for surgical teams are playing a pivotal role in the medical robotics market. As robotic systems become more prevalent, the need for skilled professionals who can operate these technologies effectively is paramount. Medical institutions are increasingly investing in simulation-based training programs to ensure that surgeons are proficient in robotic techniques. This trend is likely to enhance the overall adoption of robotic systems in surgical settings. Furthermore, as training programs evolve, they may contribute to a more significant acceptance of robotic-assisted surgeries among healthcare providers, thereby propelling growth in the medical robotics market.

Growing Focus on Patient Safety and Outcomes

The medical robotics market is increasingly shaped by an emphasis on patient safety and improved surgical outcomes. Robotic-assisted surgeries are associated with lower complication rates and shorter hospital stays, which are critical factors for both patients and healthcare providers. As hospitals prioritize quality of care, the adoption of robotic systems is likely to rise. Recent studies indicate that robotic surgeries can reduce the risk of infection by up to 50%, making them an attractive option for surgical teams. This focus on safety and outcomes is expected to drive the medical robotics market forward, as more institutions recognize the value of investing in robotic technologies.

Increased Investment in Healthcare Technology

Investment in healthcare technology is a critical driver of the medical robotics market. As hospitals and healthcare systems strive to enhance operational efficiency and patient outcomes, they are allocating significant resources towards advanced technologies, including robotics. In 2025, healthcare technology investments are expected to exceed $200 billion in the U.S., with a substantial portion directed towards robotic systems. This influx of capital is likely to foster innovation, leading to the development of more sophisticated robotic solutions that can be integrated into various medical procedures. Consequently, the medical robotics market is poised for substantial growth as healthcare providers adopt these technologies to remain competitive.