Aging Population and Healthcare Demand

The demographic shift towards an aging population in South Korea is significantly impacting the medical robotics market. As the elderly population increases, there is a corresponding rise in the demand for surgical procedures, particularly in orthopedics and cardiology. This trend is expected to drive the market for robotic surgical systems, as they offer enhanced precision and reduced recovery times. By 2025, it is estimated that the elderly population will account for over 20% of the total population, further intensifying the need for advanced medical technologies. Consequently, healthcare providers are likely to invest more in robotic solutions to meet this growing demand.

Technological Advancements in Robotics

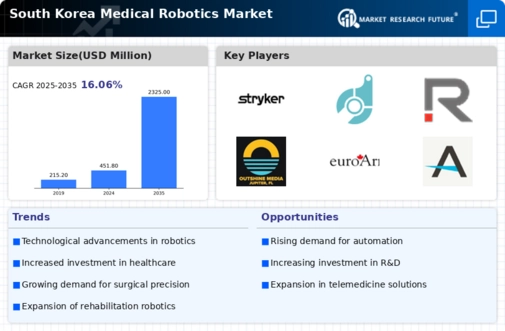

The medical robotics market is experiencing rapid technological advancements, particularly in South Korea. Innovations in robotic systems, such as enhanced precision and minimally invasive techniques, are driving the adoption of robotic-assisted surgeries. The integration of advanced imaging technologies and real-time data analytics is improving surgical outcomes and patient safety. As a result, hospitals are increasingly investing in robotic systems, with the market projected to grow at a CAGR of approximately 15% over the next five years. This growth is indicative of the increasing reliance on robotics in surgical procedures, which is reshaping the landscape of healthcare delivery in South Korea.

Competitive Landscape and Market Dynamics

The competitive landscape of the medical robotics market in South Korea is becoming increasingly dynamic. Numerous companies are entering the market, introducing innovative robotic solutions that cater to various surgical specialties. This influx of new entrants is fostering a competitive environment that encourages continuous improvement and innovation. Established players are also expanding their product offerings and enhancing their technologies to maintain market share. As a result, the medical robotics market is likely to witness significant growth, with projections indicating a market value exceeding $1 billion by 2026. This competitive drive is essential for advancing the capabilities and applications of medical robotics.

Government Support and Funding Initiatives

Government initiatives in South Korea are playing a crucial role in the growth of the medical robotics market. The South Korean government has been actively promoting the development and adoption of robotic technologies through funding programs and policy support. For instance, substantial investments have been allocated to research and development in medical robotics, with funding exceeding $100 million in recent years. This support not only encourages innovation but also facilitates collaboration between academic institutions and industry players. As a result, the medical robotics market is expected to benefit from enhanced technological capabilities and increased market penetration.

Rising Awareness and Acceptance of Robotic Surgery

There is a growing awareness and acceptance of robotic surgery among both healthcare professionals and patients in South Korea. Educational campaigns and successful case studies are contributing to a positive perception of robotic-assisted procedures. As patients become more informed about the benefits of robotic surgery, such as shorter hospital stays and quicker recovery times, the demand for these services is likely to increase. This shift in patient attitudes is expected to drive the medical robotics market, as more healthcare facilities adopt robotic systems to meet patient expectations and improve surgical outcomes.