Enhanced Training and Education Programs

the medical robotics market in France benefits from enhanced training and education programs aimed at healthcare professionals. As robotic systems become more prevalent in surgical settings, the need for skilled personnel to operate these technologies is paramount. Various institutions and organizations are developing comprehensive training programs that focus on the effective use of robotic systems in surgery. These initiatives not only improve the proficiency of surgeons but also foster greater acceptance of robotic technologies within the medical community. Furthermore, the establishment of simulation-based training environments allows for hands-on experience, which is crucial for mastering complex robotic procedures. As a result, the emphasis on training and education is likely to drive the growth of the medical robotics market, ensuring that healthcare professionals are well-equipped to utilize advanced robotic systems effectively.

Aging Population and Increased Surgical Needs

The aging population in France is a significant driver for the medical robotics market, as older individuals typically require more surgical interventions. With a demographic shift towards an older population, the demand for surgeries, particularly orthopedic and cardiovascular procedures, is expected to rise. This trend necessitates the adoption of robotic systems that can perform complex surgeries with greater precision and reduced recovery times. Data suggests that by 2030, nearly 25% of the French population will be over 65 years old, further amplifying the need for advanced surgical solutions. As healthcare providers strive to meet the growing surgical demands of an aging population, the medical robotics market is likely to expand, driven by the need for innovative technologies that enhance surgical outcomes and patient safety.

Growing Investment in Healthcare Infrastructure

the medical robotics market in France is influenced by the growing investment in healthcare infrastructure. The French government and private sector are increasingly allocating funds to modernize hospitals and healthcare facilities, which includes the acquisition of advanced medical technologies. Recent reports indicate that healthcare spending in France is projected to reach €250 billion by 2026, with a substantial portion earmarked for technological advancements. This investment is likely to facilitate the adoption of robotic systems, as hospitals seek to enhance their surgical capabilities and improve patient care. Moreover, the emphasis on upgrading healthcare infrastructure aligns with the broader goal of improving healthcare delivery and outcomes. Consequently, the growing investment in healthcare infrastructure serves as a vital driver for the medical robotics market, enabling the integration of cutting-edge robotic technologies into clinical practice.

Rising Demand for Minimally Invasive Procedures

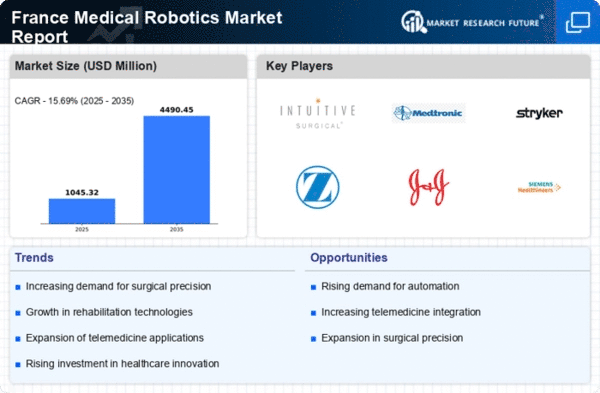

the medical robotics market in France is experiencing a surge in demand for minimally invasive surgical procedures. This trend is driven by the increasing preference among patients for surgeries that promise reduced recovery times and lower risk of complications. As a result, healthcare providers are increasingly investing in robotic surgical systems that facilitate such procedures. According to recent data, the market for robotic-assisted surgeries is projected to grow at a CAGR of approximately 15% over the next five years. This growth is indicative of the broader acceptance of robotic technologies in surgical settings, which enhances precision and efficiency. Consequently, the rising demand for minimally invasive procedures is a significant driver for the medical robotics market, as it compels hospitals and clinics to adopt advanced robotic systems to meet patient expectations and improve surgical outcomes.

Integration of Artificial Intelligence in Robotics

The integration of artificial intelligence (AI) into robotic systems is transforming the medical robotics market in France. AI technologies enhance the capabilities of robotic systems, allowing for improved decision-making, real-time data analysis, and enhanced surgical precision. This integration appears to be a game-changer, as it not only optimizes surgical procedures but also aids in preoperative planning and postoperative assessments. The medical robotics market is likely to benefit from this technological evolution, with AI-driven robots expected to account for a substantial share of the market by 2030. Furthermore, the potential for AI to reduce human error and improve patient outcomes is driving healthcare institutions to invest in these advanced systems. As a result, the incorporation of AI into medical robotics is a critical driver, fostering innovation and expanding the applications of robotic technologies in healthcare.