Increased Focus on Patient-Centric Care

The medical device-connectivity market is increasingly aligning with the shift towards patient-centric care models. Healthcare providers are recognizing the importance of involving patients in their own care processes, which is driving the demand for connected devices that empower patients to monitor their health. This trend is reflected in the growing adoption of wearable devices and mobile health applications. Market analysis indicates that the patient engagement segment is expected to grow by approximately 25% over the next few years. By providing patients with real-time access to their health data, connected devices enhance their ability to manage chronic conditions and adhere to treatment plans. This focus on patient-centricity is likely to further stimulate growth in the medical device-connectivity market.

Rising Demand for Remote Patient Monitoring

The medical device-connectivity market is witnessing a notable increase in demand for remote patient monitoring solutions. As healthcare providers seek to enhance patient engagement and reduce hospital readmissions, connected devices that facilitate remote monitoring are becoming essential. According to recent data, the remote patient monitoring segment is anticipated to grow by over 20% in the coming years. This growth is driven by the need for continuous health monitoring, especially for chronic conditions. The integration of connected devices allows for real-time data collection and analysis, enabling healthcare professionals to make informed decisions. Consequently, this trend is likely to bolster the medical device-connectivity market, as more healthcare systems adopt these technologies to improve patient care.

Regulatory Support for Connectivity Standards

The medical device-connectivity market is experiencing a surge in regulatory support aimed at establishing connectivity standards. Regulatory bodies, such as the FDA, are actively promoting frameworks that facilitate interoperability among devices. This initiative is crucial as it enhances data sharing and communication between devices, ultimately improving patient outcomes. The FDA's recent guidelines emphasize the importance of secure and efficient data exchange, which is expected to drive market growth. As a result, manufacturers are increasingly investing in compliant technologies, leading to a projected market growth rate of approximately 15% annually. This regulatory environment not only fosters innovation but also instills confidence among healthcare providers and patients, thereby propelling the medical device-connectivity market forward.

Technological Advancements in Device Connectivity

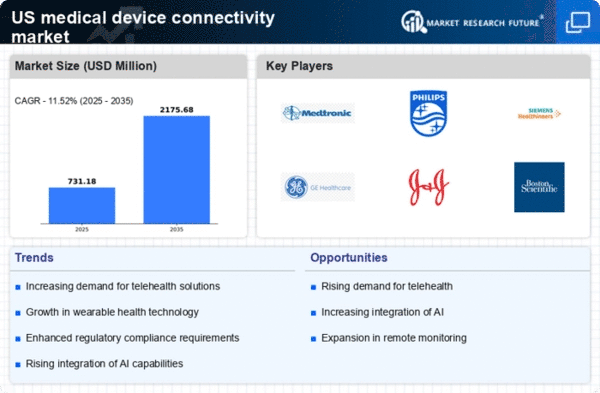

Technological advancements are playing a pivotal role in shaping the medical device-connectivity market. Innovations such as 5G technology and the Internet of Things (IoT) are enhancing the capabilities of medical devices, allowing for faster and more reliable data transmission. These advancements enable devices to communicate seamlessly, which is crucial for applications like telemedicine and remote diagnostics. The market is projected to grow significantly, with estimates suggesting an increase of around 18% annually due to these technological improvements. As devices become more interconnected, healthcare providers can leverage data analytics to improve patient outcomes and operational efficiency. This trend underscores the importance of continuous innovation in the medical device-connectivity market.

Integration of Artificial Intelligence in Healthcare

The integration of artificial intelligence (AI) into healthcare is emerging as a transformative driver for the medical device-connectivity market. AI technologies are being utilized to analyze vast amounts of data generated by connected devices, leading to improved diagnostic accuracy and personalized treatment plans. The market for AI in healthcare is projected to grow at a compound annual growth rate (CAGR) of over 30% in the coming years. This rapid growth is indicative of the increasing reliance on AI to enhance decision-making processes in clinical settings. As healthcare providers adopt AI-driven solutions, the demand for connected medical devices that can seamlessly integrate with these technologies is expected to rise. This trend highlights the potential for AI to revolutionize the medical device-connectivity market.