Government Initiatives and Support

Government initiatives play a crucial role in shaping the medical device-connectivity market in South Korea. The South Korean government has been actively promoting the adoption of advanced healthcare technologies through various funding programs and incentives. For instance, the Ministry of Health and Welfare has allocated substantial budgets to support the development and integration of connected medical devices in healthcare settings. This support is indicative of a broader strategy to enhance healthcare delivery and improve patient outcomes. As a result, the medical device-connectivity market is likely to benefit from increased investments and favorable regulatory environments, fostering innovation and growth in the sector.

Growing Focus on Personalized Medicine

The medical device-connectivity market is witnessing a growing focus on personalized medicine in South Korea. As healthcare shifts towards more individualized treatment approaches, the demand for connected medical devices that can provide tailored health solutions is increasing. Personalized medicine relies heavily on data analytics and connectivity to deliver customized treatment plans based on individual patient profiles. This trend is expected to drive the market as healthcare providers seek to enhance patient engagement and improve treatment outcomes. The ability to collect and analyze real-time data from connected devices allows for more precise interventions, thereby fostering a more effective healthcare environment.

Rising Demand for Remote Patient Monitoring

The medical device-connectivity market in South Korea is experiencing a notable surge in demand for remote patient monitoring solutions. This trend is driven by an increasing prevalence of chronic diseases, which necessitates continuous health monitoring. According to recent data, approximately 30% of the South Korean population is affected by chronic conditions, leading to a heightened need for devices that can facilitate real-time health tracking. The integration of connectivity features in medical devices allows healthcare providers to monitor patients remotely, improving patient outcomes and reducing hospital visits. This shift towards remote monitoring is expected to propel the market forward, as it aligns with the broader healthcare strategy of enhancing patient care while optimizing resource utilization.

Technological Advancements in Medical Devices

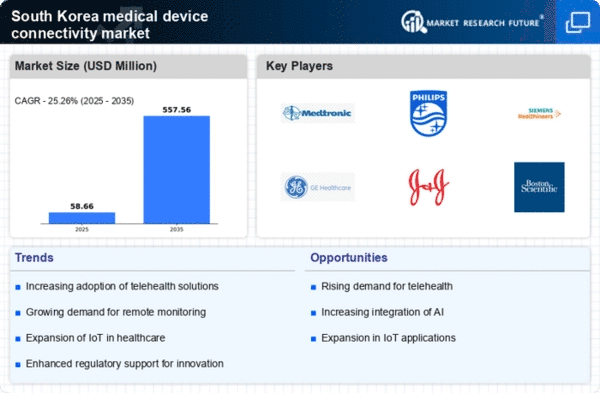

Technological advancements are significantly influencing the medical device-connectivity market in South Korea. Innovations such as the Internet of Things (IoT) and cloud computing are enabling the development of sophisticated medical devices that can communicate seamlessly with healthcare systems. These advancements facilitate the collection and analysis of patient data, leading to more informed clinical decisions. The market is projected to grow at a CAGR of around 15% over the next five years, driven by the increasing integration of smart technologies in medical devices. This trend not only enhances the functionality of medical devices but also improves the overall efficiency of healthcare delivery.

Increased Investment in Health IT Infrastructure

Investment in health IT infrastructure is a key driver of the medical device-connectivity market in South Korea. The government and private sector are channeling resources into upgrading healthcare facilities with advanced IT systems that support connectivity among medical devices. This investment is crucial for enabling interoperability and ensuring that devices can communicate effectively within healthcare ecosystems. As of 2025, it is estimated that health IT spending in South Korea will reach approximately $3 billion, reflecting a commitment to enhancing healthcare delivery through technology. This focus on infrastructure development is likely to bolster the medical device-connectivity market, facilitating the integration of innovative solutions into everyday healthcare practices.