Growing Demand for Telehealth Solutions

The medical device-connectivity market in Japan is experiencing a notable surge in demand for telehealth solutions. This trend is driven by the increasing need for remote healthcare services, particularly in rural areas where access to medical facilities is limited. As of 2025, it is estimated that telehealth services could account for approximately 30% of all healthcare interactions in Japan. The integration of connected medical devices facilitates real-time monitoring and communication between patients and healthcare providers, enhancing patient outcomes and satisfaction. Furthermore, the Japanese government has been actively promoting telehealth initiatives, which further supports the growth of the medical device-connectivity market. This shift towards telehealth not only improves healthcare accessibility but also reduces the burden on traditional healthcare systems, indicating a transformative change in how healthcare is delivered in Japan.

Technological Advancements in Medical Devices

Technological advancements are playing a pivotal role in shaping the medical device-connectivity market in Japan. Innovations such as the Internet of Things (IoT), artificial intelligence (AI), and machine learning are being integrated into medical devices, enhancing their functionality and connectivity. These advancements allow for more sophisticated data collection and analysis, enabling healthcare providers to make informed decisions based on real-time patient data. As of 2025, it is projected that the market for AI-enabled medical devices could grow by over 20%, reflecting the increasing reliance on technology in healthcare. The continuous evolution of technology not only improves the efficiency of medical devices but also enhances patient engagement and adherence to treatment plans, indicating a promising future for the medical device-connectivity market.

Aging Population and Chronic Disease Management

Japan's aging population is a critical factor influencing the medical device-connectivity market. With over 28% of the population aged 65 and older, there is a growing prevalence of chronic diseases such as diabetes and cardiovascular conditions. This demographic shift necessitates the adoption of connected medical devices that enable continuous monitoring and management of health conditions. The medical device-connectivity market is expected to see a substantial increase in demand for devices that facilitate remote monitoring and data sharing between patients and healthcare providers. By 2025, it is anticipated that the market for chronic disease management devices could reach approximately $2 billion in Japan. This trend underscores the importance of connectivity in enhancing patient care and improving health outcomes for the elderly population.

Increased Investment in Healthcare Infrastructure

Investment in healthcare infrastructure in Japan is a significant driver for the medical device-connectivity market. The government has committed substantial resources to modernize healthcare facilities and integrate advanced technologies. This investment is aimed at improving healthcare delivery and ensuring that medical institutions are equipped with the latest connected devices. As of 2025, it is estimated that healthcare spending in Japan will reach approximately $500 billion, with a considerable portion allocated to upgrading medical technology. This focus on infrastructure not only enhances the capabilities of healthcare providers but also creates a conducive environment for the adoption of connected medical devices. The ongoing improvements in healthcare infrastructure are likely to stimulate growth in the medical device-connectivity market, fostering innovation and enhancing patient care.

Regulatory Support for Digital Health Innovations

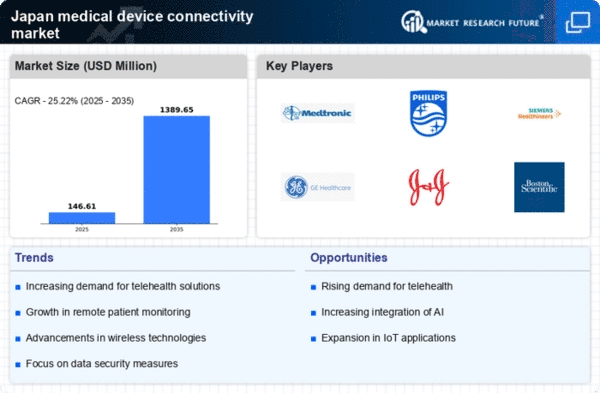

Regulatory frameworks in Japan are increasingly supportive of digital health innovations, which is a significant driver for the medical device-connectivity market. The Pharmaceuticals and Medical Devices Agency (PMDA) has streamlined approval processes for connected medical devices, encouraging manufacturers to innovate and bring new products to market. This regulatory environment fosters a culture of collaboration between technology developers and healthcare providers, facilitating the integration of advanced connectivity features in medical devices. As a result, the market is projected to grow at a CAGR of around 15% over the next five years. The proactive stance of regulatory bodies not only enhances the safety and efficacy of medical devices but also instills confidence among consumers and healthcare professionals, thereby propelling the medical device-connectivity market forward.