Emergence of Autonomous Vessels

The emergence of autonomous vessels represents a transformative trend within the US Marine Radar Market. As the maritime industry increasingly embraces automation, the demand for sophisticated radar systems capable of supporting autonomous navigation is on the rise. These systems must provide real-time data and situational awareness to ensure safe operations without human intervention. Recent advancements in sensor technology and data analytics are enabling the development of radar systems that can seamlessly integrate with autonomous vessels. Market Research Future suggest that the market for autonomous shipping could reach USD 135 billion by 2030, further driving the need for advanced radar solutions. Consequently, the US Marine Radar Market is likely to evolve rapidly, as manufacturers innovate to meet the requirements of this burgeoning segment.

Increased Focus on Maritime Security

The US Marine Radar Market is significantly influenced by the heightened focus on maritime security. With rising concerns over piracy, smuggling, and illegal fishing, there is a growing demand for advanced radar systems that can enhance surveillance and monitoring capabilities. The US Coast Guard has been actively investing in modernizing its fleet with state-of-the-art radar technology to bolster national security. Recent reports indicate that the US government allocated substantial funding for maritime security initiatives, which includes upgrading radar systems on vessels. This trend is likely to continue, as the need for effective maritime domain awareness becomes increasingly critical. Consequently, the US Marine Radar Market is poised for growth as stakeholders seek innovative solutions to address security challenges.

Regulatory Influence on Market Growth

The regulatory landscape plays a pivotal role in shaping the US Marine Radar Market. Government agencies, such as the Federal Aviation Administration (FAA) and the Coast Guard, impose stringent regulations to ensure maritime safety and environmental protection. These regulations often mandate the installation of advanced radar systems on commercial vessels, thereby driving market growth. For instance, the implementation of the Vessel Traffic Service (VTS) regulations has led to a surge in demand for radar systems that comply with safety standards. Additionally, the US government is investing in infrastructure improvements, which further stimulates the market. The anticipated increase in regulatory requirements is expected to propel the US Marine Radar Market, as manufacturers strive to meet compliance and enhance their product offerings.

Growth of the Commercial Shipping Sector

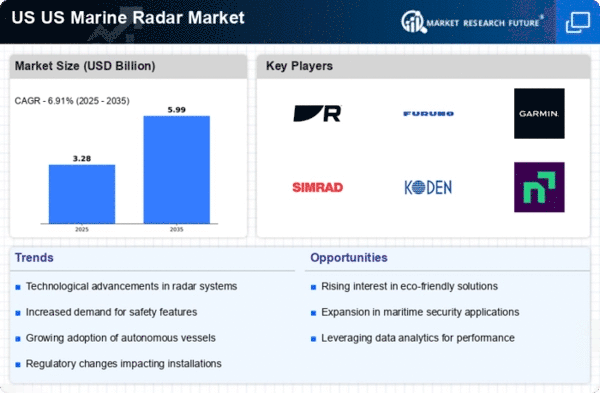

The expansion of the commercial shipping sector is a significant driver for the US Marine Radar Market. As global trade continues to increase, the demand for efficient and safe shipping operations rises correspondingly. The US is home to numerous ports that facilitate international trade, necessitating the use of advanced radar systems for navigation and traffic management. According to industry forecasts, the commercial shipping sector is projected to grow at a compound annual growth rate (CAGR) of 4% over the next five years. This growth is likely to stimulate investments in marine radar technology, as shipping companies seek to enhance operational efficiency and safety. The US Marine Radar Market stands to benefit from this trend, as manufacturers develop tailored solutions to meet the evolving needs of the commercial shipping sector.

Technological Advancements in Radar Systems

The US Marine Radar Market is experiencing a notable transformation due to rapid technological advancements. Innovations such as solid-state radar systems and advanced signal processing techniques are enhancing the accuracy and reliability of marine radar. These developments are crucial for applications in navigation, collision avoidance, and search and rescue operations. According to recent data, the integration of artificial intelligence and machine learning into radar systems is expected to improve target detection rates by up to 30%. Furthermore, the adoption of 3D radar technology is gaining traction, providing comprehensive situational awareness for maritime operators. As a result, the US Marine Radar Market is likely to witness increased demand for sophisticated radar solutions that can operate effectively in diverse environmental conditions.