Demand for Personalized Medicine

The live cell-imaging market is being propelled by the growing demand for personalized medicine, which emphasizes tailored treatment approaches based on individual patient profiles. This shift is particularly evident in oncology, where live cell imaging is utilized to monitor tumor responses to therapies in real-time. In the US, the personalized medicine market is projected to reach $2 trillion by 2025, indicating a substantial opportunity for live cell-imaging technologies to play a pivotal role in this transformation. As healthcare providers increasingly adopt personalized treatment strategies, the live cell-imaging market is likely to expand, driven by the need for precise and dynamic imaging solutions that can inform clinical decisions.

Growing Prevalence of Chronic Diseases

The live cell-imaging market is significantly influenced by the rising prevalence of chronic diseases, such as cancer and diabetes. As these conditions become more widespread, there is an increasing demand for effective diagnostic and therapeutic solutions. Live cell imaging plays a crucial role in understanding disease mechanisms and developing targeted treatments. In the US, the National Cancer Institute reports that cancer cases are expected to rise by 30% by 2030, which may drive the need for advanced imaging technologies. Consequently, the live cell-imaging market is likely to expand as healthcare providers seek innovative tools to improve patient outcomes and enhance research capabilities.

Integration of Artificial Intelligence

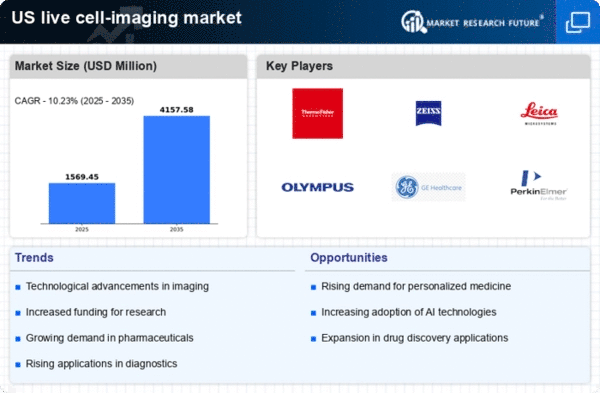

The integration of artificial intelligence (AI) into the live cell-imaging market is transforming the landscape of biological research. AI technologies are being utilized to analyze complex imaging data, enabling researchers to extract meaningful insights more efficiently. This trend is particularly relevant in the US, where the adoption of AI in healthcare is projected to grow at a CAGR of 40% over the next five years. By automating data analysis and enhancing image processing capabilities, AI is expected to streamline workflows and improve the accuracy of live cell imaging. As a result, the live cell-imaging market may witness increased adoption rates, as researchers leverage these advanced tools to accelerate their studies.

Expansion of Biopharmaceutical Industry

The expansion of the biopharmaceutical industry is a key driver for the live cell-imaging market. As biopharmaceutical companies continue to innovate and develop new therapies, the demand for advanced imaging techniques to monitor cellular responses and drug interactions is increasing. In the US, the biopharmaceutical sector is expected to grow at a CAGR of 8% through 2027, fueled by advancements in biologics and gene therapies. This growth presents a significant opportunity for live cell-imaging technologies, which are essential for conducting preclinical and clinical studies. Consequently, the live cell-imaging market is likely to benefit from the ongoing expansion of the biopharmaceutical industry, as researchers seek to enhance their understanding of complex biological processes.

Rising Investment in Research and Development

The live cell-imaging market is experiencing a surge in investment, particularly in research and development initiatives. This trend is driven by the increasing need for advanced imaging techniques in various fields, including drug discovery and cellular biology. In the US, funding for biotechnology and life sciences has seen a notable increase, with estimates suggesting that R&D spending in these sectors could reach $200 billion by 2026. This influx of capital is likely to enhance the capabilities of live cell-imaging technologies, enabling researchers to conduct more sophisticated experiments and analyses. As a result, the live cell-imaging market is poised for growth, as innovative solutions emerge to meet the evolving demands of the scientific community.