Expansion of Biotechnology Sector

Japan's biotechnology sector is expanding rapidly, contributing significantly to the growth of the live cell-imaging market. With an estimated market size of $10 billion in 2025, biotechnology firms are increasingly adopting live cell-imaging technologies to enhance their research capabilities. This expansion is fueled by the need for innovative solutions in drug discovery and development. Live cell imaging provides critical insights into cellular behavior, enabling researchers to identify potential drug candidates more efficiently. As the biotechnology landscape continues to evolve, the demand for advanced imaging solutions is likely to increase, further driving the live cell-imaging market in Japan.

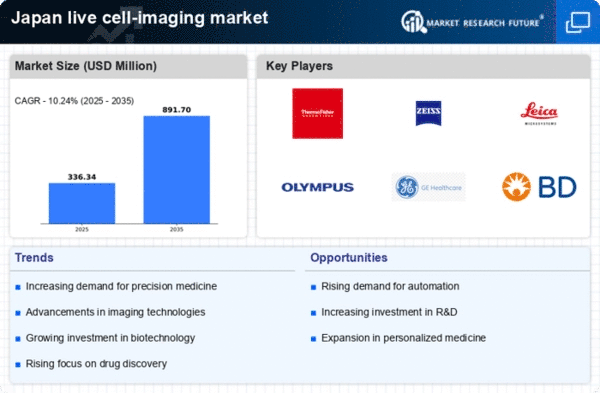

Advancements in Imaging Technologies

Technological advancements in imaging modalities are significantly impacting the live cell-imaging market in Japan. Innovations such as super-resolution microscopy and high-content screening are enhancing the capabilities of researchers to visualize cellular processes with unprecedented clarity. These advancements are expected to drive market growth as they enable more detailed studies of cellular dynamics. In 2025, the market for advanced imaging technologies is projected to grow by 20%, reflecting the increasing demand for high-resolution imaging solutions. As researchers seek to explore complex biological systems, the live cell-imaging market is likely to benefit from these technological breakthroughs.

Growing Academic Research Initiatives

The live cell-imaging market is benefiting from a surge in academic research initiatives across Japan. Universities and research institutions are increasingly investing in advanced imaging technologies to facilitate groundbreaking studies in cellular biology and related fields. In 2025, funding for academic research in Japan is projected to exceed $3 billion, with a significant portion allocated to live cell imaging. This influx of funding is likely to enhance the capabilities of researchers, allowing for more sophisticated experiments and a deeper understanding of cellular processes. As academic institutions continue to prioritize innovative research, the live cell-imaging market is expected to thrive.

Rising Demand for Personalized Medicine

The live cell-imaging market in Japan is experiencing a notable surge in demand driven by the increasing focus on personalized medicine. As healthcare shifts towards tailored treatments, researchers require advanced imaging techniques to monitor cellular responses to specific therapies. This trend is reflected in the growing investments in biopharmaceutical research, which reached approximately $5 billion in 2025. The ability to visualize live cells in real-time allows for a deeper understanding of disease mechanisms and treatment efficacy, thereby enhancing the development of personalized therapies. Consequently, the live cell-imaging market is poised for growth as it supports the evolving landscape of precision medicine in Japan.

Increased Collaboration Between Industry and Academia

Collaboration between industry and academia is becoming a pivotal driver for the live cell-imaging market in Japan. Partnerships between research institutions and biotechnology companies are fostering innovation and accelerating the development of new imaging technologies. These collaborations often lead to the sharing of resources and expertise, which enhances the overall research landscape. In 2025, it is anticipated that such partnerships will contribute to a 15% increase in the adoption of live cell-imaging technologies within academic settings. This synergy not only benefits the live cell-imaging market but also propels advancements in scientific research and development.