Expansion of Research Institutions

The live cell-imaging market is being propelled by the expansion of research institutions and academic facilities in the UK. As universities and research centres enhance their capabilities, the need for advanced imaging technologies becomes increasingly critical. In 2025, it is estimated that the number of research institutions utilizing live cell imaging will increase by 20%, reflecting a growing recognition of its importance in biological research. This expansion is likely to foster collaborations between academia and industry, further stimulating innovation and adoption of live cell imaging technologies within the market.

Growing Investment in Biotechnology

The live cell-imaging market is benefiting from the increasing investment in biotechnology sectors across the UK. With the government and private entities allocating substantial funds towards biopharmaceutical research, the demand for sophisticated imaging technologies is expected to rise. In 2025, the UK biotechnology sector is projected to reach a market value of £45 billion, with a significant portion directed towards research facilities that utilize live cell imaging. This influx of capital is likely to enhance the capabilities of laboratories, enabling them to conduct more complex experiments and analyses, thereby driving the growth of the live cell-imaging market.

Advancements in Imaging Technologies

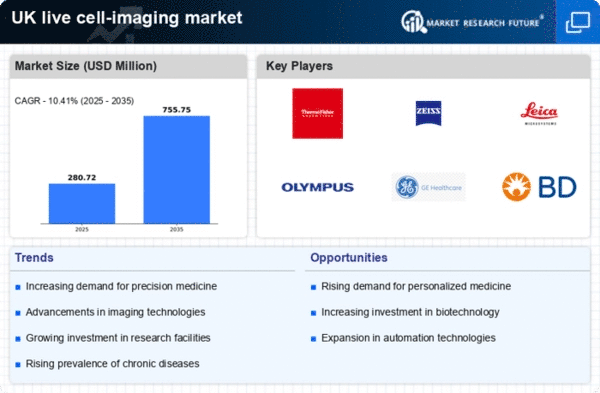

The live cell-imaging market is significantly influenced by ongoing advancements in imaging technologies. Innovations such as high-resolution microscopy and automated imaging systems are enhancing the capabilities of live cell imaging, making it more accessible and effective for researchers. In 2025, the market is expected to grow by approximately 15% as new technologies emerge, allowing for more detailed and dynamic studies of cellular processes. These advancements are likely to attract a broader range of users, from academic researchers to pharmaceutical companies, thereby expanding the overall market landscape.

Rising Demand for Personalized Medicine

The live cell-imaging market is experiencing a notable surge in demand due to the increasing focus on personalized medicine. As healthcare shifts towards tailored treatments, the need for advanced imaging techniques that can monitor cellular responses in real-time becomes paramount. This trend is particularly evident in oncology, where live cell imaging allows for the assessment of drug efficacy on individual patient cells. The UK healthcare system is investing heavily in research and development, with funding reaching approximately £1.5 billion in 2025 for innovative medical technologies. This investment is likely to bolster the live cell-imaging market, as researchers seek to develop more effective therapies that cater to specific patient profiles.

Increased Focus on Drug Development Efficiency

The live cell-imaging market is witnessing growth driven by the heightened emphasis on improving drug development efficiency. Pharmaceutical companies are increasingly adopting live cell imaging techniques to streamline their research processes, reduce time-to-market, and enhance the accuracy of preclinical studies. In 2025, it is anticipated that around 30% of drug development projects in the UK will incorporate live cell imaging as a standard practice. This shift not only accelerates the discovery of new therapeutics but also minimizes costs associated with failed trials, thereby reinforcing the market's expansion.