Government Policies and Incentives

Government policies and incentives aimed at promoting clean energy technologies are significantly influencing the Lithium-Ion Battery Cathode Material Market. Many countries are implementing regulations that encourage the use of electric vehicles and renewable energy sources, thereby increasing the demand for lithium-ion batteries. For example, tax credits and subsidies for EV purchases are becoming commonplace, which in turn drives the need for efficient cathode materials. In 2025, it is anticipated that these policies will lead to a 20% increase in the demand for lithium-ion batteries, further stimulating the cathode material market. This regulatory support is essential for fostering innovation and investment in the Lithium-Ion Battery Cathode Material Market.

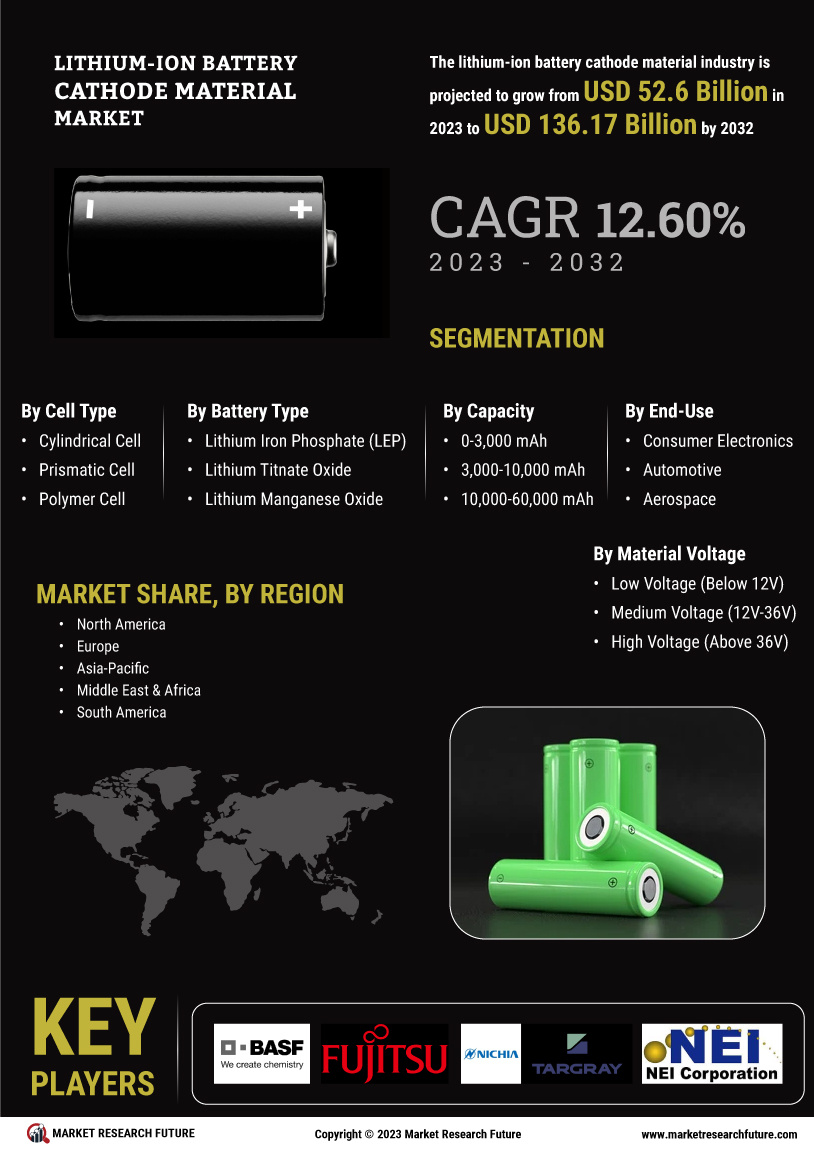

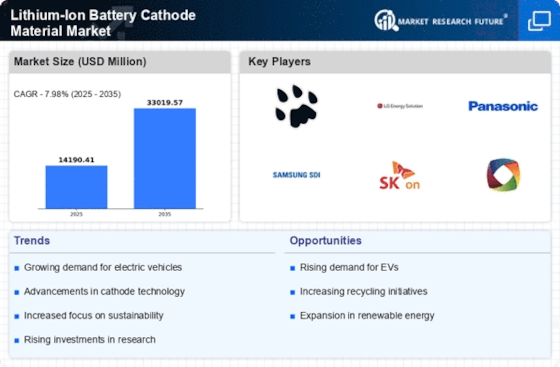

Rising Demand for Electric Vehicles

The increasing adoption of electric vehicles (EVs) is a primary driver for the Lithium-Ion Battery Cathode Material Market. As consumers and manufacturers alike prioritize sustainability, the demand for EVs continues to surge. In 2025, the number of electric vehicles on the road is projected to exceed 30 million units, significantly boosting the need for high-performance lithium-ion batteries. This trend is likely to propel the demand for cathode materials, which are essential for enhancing battery efficiency and longevity. Consequently, manufacturers are investing in advanced cathode materials to meet the evolving requirements of the automotive sector, thereby shaping the landscape of the Lithium-Ion Battery Cathode Material Market.

Increasing Consumer Electronics Demand

The surging demand for consumer electronics is a vital driver of the Lithium-Ion Battery Cathode Material Market. With the proliferation of smartphones, laptops, and wearable devices, the need for efficient and long-lasting batteries is more pronounced than ever. In 2025, the consumer electronics sector is expected to account for approximately 40% of the total lithium-ion battery market, thereby significantly impacting the cathode material demand. Manufacturers are focusing on developing cathode materials that can provide higher energy density and faster charging capabilities to meet consumer expectations. This trend not only drives innovation but also shapes the competitive landscape of the Lithium-Ion Battery Cathode Material Market.

Growth of Renewable Energy Storage Solutions

The expansion of renewable energy storage solutions is a crucial driver for the Lithium-Ion Battery Cathode Material Market. As the world shifts towards renewable energy sources, the need for efficient energy storage systems becomes paramount. Lithium-ion batteries are increasingly being utilized in grid storage applications to manage the intermittent nature of renewable energy. By 2025, the market for energy storage systems is projected to reach USD 20 billion, with lithium-ion batteries accounting for a significant share. This growth underscores the importance of high-quality cathode materials in ensuring the reliability and efficiency of energy storage solutions, thereby enhancing the overall performance of the Lithium-Ion Battery Cathode Material Market.

Technological Innovations in Battery Chemistry

Technological advancements in battery chemistry are transforming the Lithium-Ion Battery Cathode Material Market. Innovations such as the development of nickel-rich cathodes and solid-state batteries are enhancing energy density and safety. For instance, nickel-cobalt-aluminum (NCA) and nickel-manganese-cobalt (NMC) chemistries are gaining traction due to their superior performance characteristics. As of 2025, the market for advanced cathode materials is expected to grow at a compound annual growth rate (CAGR) of over 15%, driven by these innovations. This growth indicates a shift towards more efficient and sustainable battery solutions, which are crucial for meeting the energy demands of various applications, including consumer electronics and renewable energy storage.