Growing Focus on Energy Efficiency

The led oled-display market is witnessing a growing focus on energy efficiency, driven by both consumer preferences and regulatory pressures. As energy costs rise and environmental concerns become more prominent, consumers are increasingly seeking displays that offer lower energy consumption without compromising performance. The market is projected to grow by approximately 11% annually as manufacturers develop energy-efficient technologies that meet these demands. This trend is particularly relevant in commercial applications, where energy savings can lead to significant cost reductions. Consequently, the led oled-display market is likely to see a shift towards products that prioritize sustainability while delivering high-quality visual experiences.

Expansion of Smart Home Technologies

The integration of smart home technologies is significantly influencing the led oled-display market. As consumers adopt smart home devices, the demand for compatible displays that enhance user experience is on the rise. The market is expected to witness a growth rate of around 12% annually as smart TVs and connected devices become more prevalent. These displays not only serve as entertainment hubs but also as control centers for various smart home functionalities. The seamless integration of displays with smart home ecosystems is likely to drive innovation in the led oled-display market, as manufacturers strive to create products that offer both functionality and aesthetic appeal.

Rising Consumer Demand for High-Quality Displays

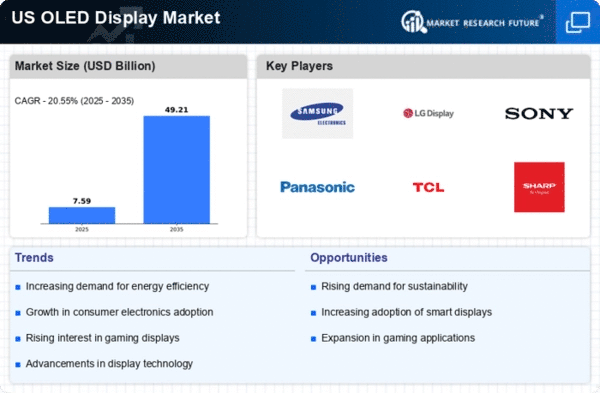

The led oled-display market is experiencing a surge in consumer demand for high-quality visual experiences. As consumers increasingly seek superior picture quality for entertainment and professional applications, manufacturers are responding by enhancing display technologies. The market is projected to grow at a CAGR of approximately 15% from 2025 to 2030, driven by the need for vibrant colors and deeper contrasts. This trend is particularly evident in sectors such as gaming, where immersive experiences are paramount. Additionally, the proliferation of 4K and 8K content is further fueling the demand for advanced display technologies. Consequently, the led oled-display market is positioned to benefit from this growing consumer preference, as manufacturers innovate to meet the expectations of discerning users.

Increased Investment in Advertising and Marketing

The led oled-display market is benefiting from increased investment in advertising and marketing strategies. Businesses are recognizing the effectiveness of high-quality displays in capturing consumer attention and enhancing brand visibility. The market is projected to grow by approximately 10% annually as companies invest in digital signage and advertising solutions that utilize led oled technology. This trend is particularly pronounced in retail environments, where vibrant displays can significantly influence purchasing decisions. As businesses continue to allocate budgets towards innovative advertising solutions, the led oled-display market is likely to see sustained growth driven by this demand for impactful visual communication.

Technological Innovations in Display Manufacturing

Technological innovations in display manufacturing are playing a crucial role in shaping the led oled-display market. Advances in production techniques and materials are enabling manufacturers to create thinner, lighter, and more energy-efficient displays. The market is anticipated to grow at a rate of 14% over the next five years, as these innovations lead to improved performance and reduced costs. Enhanced manufacturing processes not only increase the quality of displays but also expand their applications across various sectors, including automotive and healthcare. As manufacturers continue to invest in research and development, the led oled-display market is likely to benefit from a wave of new products that push the boundaries of display technology.