Integration of Advanced Technologies

The integration of advanced technologies is a pivotal driver for the Interactive Flat Panel Display Market. Innovations such as artificial intelligence, augmented reality, and cloud connectivity are transforming the functionality of interactive displays. These technologies enable seamless collaboration, real-time data sharing, and enhanced user experiences. For instance, the incorporation of AI-driven features allows for personalized content delivery, catering to individual user needs. Market analysis suggests that the adoption of such technologies could lead to a 25% increase in the efficiency of interactive displays in various sectors, including education and corporate environments. As organizations seek to leverage cutting-edge technology, the Interactive Flat Panel Display Market is poised for significant advancements and growth.

Growing Focus on Remote Collaboration

The growing focus on remote collaboration is significantly influencing the Interactive Flat Panel Display Market. As organizations adapt to flexible work arrangements, the need for effective communication tools has become paramount. Interactive flat panel displays facilitate virtual meetings, brainstorming sessions, and collaborative projects, bridging the gap between remote teams. Data indicates that companies utilizing interactive displays for remote collaboration experience a 40% increase in productivity. This trend is particularly relevant in sectors such as education and corporate training, where interactive displays enhance engagement and participation. As the demand for remote collaboration tools continues to rise, the Interactive Flat Panel Display Market is likely to see sustained growth.

Increased Investment in Smart Technologies

The Interactive Flat Panel Display Market is benefiting from increased investment in smart technologies across various sectors. Organizations are recognizing the potential of interactive displays to enhance operational efficiency and improve user experiences. The integration of smart features, such as touch interactivity and connectivity with other devices, is driving the adoption of these displays in both educational and corporate settings. Recent market data suggests that the investment in smart technologies is expected to reach over 10 billion dollars by 2026, with interactive displays being a key component of this growth. As businesses and educational institutions continue to prioritize technology investments, the Interactive Flat Panel Display Market is likely to flourish.

Corporate Training and Development Initiatives

In the realm of corporate training and development, the Interactive Flat Panel Display Market is witnessing increased adoption. Organizations are recognizing the value of interactive displays in delivering effective training sessions and workshops. The ability to present information dynamically and engage employees through interactive content enhances knowledge retention and skill acquisition. Recent statistics indicate that companies investing in interactive training solutions report a 30% improvement in employee performance. This trend is further fueled by the shift towards remote and hybrid work environments, where interactive displays facilitate virtual collaboration and training. As businesses prioritize employee development, the demand for interactive flat panel displays is expected to rise, positioning the market for substantial growth.

Rising Demand for Interactive Learning Solutions

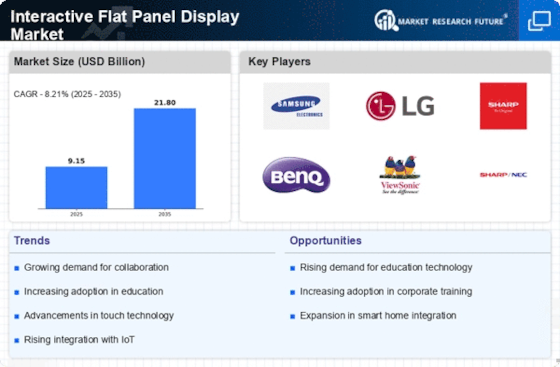

The Interactive Flat Panel Display Market is experiencing a notable surge in demand for interactive learning solutions. Educational institutions are increasingly adopting these displays to enhance student engagement and facilitate collaborative learning. According to recent data, the market for interactive displays in education is projected to grow at a compound annual growth rate of approximately 15% over the next five years. This growth is driven by the need for innovative teaching methods that incorporate technology, allowing educators to create dynamic and interactive lessons. Furthermore, the integration of touch technology and multimedia capabilities in these displays supports diverse learning styles, making them an essential tool in modern classrooms. As educational institutions continue to invest in technology, the Interactive Flat Panel Display Market is likely to expand significantly.