US Insulin Pump Market

US Insulin Pump Market Research Report: Information By Type (Patch Pumps and Tethered Pumps), By Product (MiniMed, Accu-Chek, Tandem, Omnipod, My life omnipod and Others), By Accessories (Insulin reservoirs or cartridges, Insulin set insertion devices and Battery), By End-user (Hospitals & Clinics, Homecare and Laboratories) –Market Forecast Till 2032

US Insulin Pump Market Trends

- Growth in the popularity of wearable insulin pumps is driving the market growth.

The market's growth in the popularity of wearable insulin pumps is influencing its growth. Traditional insulin pumps were typically connected to external devices and carried in a separate pouch, but wearable pumps are designed to integrate seamlessly into the user's lifestyle. These devices are compact, discreet, and can be worn directly on the body, offering greater convenience and comfort for individuals with diabetes. The shift towards wearable insulin pumps reflects a growing demand for solutions that prioritize patient comfort and encourage consistent insulin therapy adherence. Moreover, wireless connectivity enables seamless communication with other devices, such as smartphones and continuous glucose monitoring systems, providing users with real-time insights and control over their diabetes management.

Furthermore, the US is increasingly adopting hybrid closed-loop systems called artificial pancreas systems. These systems join insulin pumps with continuous glucose monitoring devices, creating a closed-loop feedback system. The CGM continuously measures glucose levels, and the integrated algorithm automatically adjusts insulin delivery in response to these real-time readings. This closed-loop functionality helps maintain blood glucose levels within a target range without constant manual intervention. As a result, individuals with diabetes experience improved stability in glycemic control and a reduced risk of complications. The convenience and enhanced automation offered by hybrid closed-loop systems contribute to better patient compliance and overall satisfaction. Thus driving the Insulin Pump market revenue.

Market Segment Insights

Insulin Pump Type Insights

The US Insulin Pump market segmentation, based on type, includes Patch pumps and Tethered pumps. The patch pumps segment mostly dominated the market. It represents an innovative insulin delivery system that adheres directly to the skin, offering discreet and convenient administration for individuals managing diabetes. These pumps provide a viable alternative to traditional insulin pump options, contributing to the market's diversification of insulin delivery methods. Their user-friendly design and potential benefits make patch pumps an increasingly relevant segment in the diabetes management landscape.

Insulin Pump Product Insights

The US Insulin Pump market segmentation, based on product, includes MiniMed, Accu-Chek, Tandem, Omnipod, My Life Omnipod, and Others. The MiniMed category generated the most income. It is a leading insulin pump brand that offers innovative solutions for diabetes management. MiniMed insulin pumps contribute significantly to the market's growth because they are renowned for their user-friendly design and advanced features. With a focus on patient convenience and improved outcomes, MiniMed remains a key player in shaping the landscape of insulin pump products in the United States.

Insulin Pump Accessories Insights

The US Insulin Pump market segmentation, based on accessories, includes insulin reservoirs or cartridges, Insulin set insertion devices, and batteries. The insulin reservoirs or cartridges segment generated the most income. It plays a pivotal role in efficiently delivering Insulin to patients using insulin pumps. Understanding the market dynamics and preferences related to insulin reservoirs or cartridges is essential for manufacturers and healthcare providers to meet the specific needs of individuals managing diabetes through insulin pump therapy.

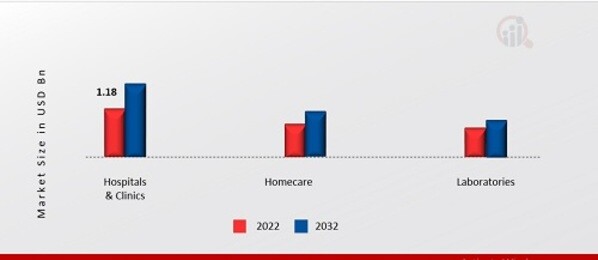

Insulin Pump End-user Insights

The US Insulin Pump market segmentation, based on end-users, includes Hospitals and clinics, Homecare and Laboratories. The hospitals & clinics category had the most income. As key stakeholders in diabetes management, hospitals, and clinics serve as crucial settings for the administration, monitoring, and education related to insulin pump therapy. This segment reflects the integral role of healthcare facilities in facilitating access to advanced diabetes care through insulin pump solutions in the US market.

Figure 1: US Insulin Pump Market, by End-user, 2022 & 2032 (USD Billion)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Insulin Pump Country Insights

With a rising prevalence of diabetes, the demand for insulin pumps continues to grow, driven by innovations in technology and a shift towards more convenient and efficient diabetes management. It is characterized by a competitive landscape, with key players introducing innovative features such as continuous glucose monitoring and smartphone integration. Additionally, favorable reimbursement policies and increasing awareness among healthcare professionals and patients contribute to market expansion. The US insulin pump market is poised for further growth, fueled by ongoing research and development, emphasizing user-friendly designs and enhanced connectivity. As the industry continues to address the evolving needs of diabetes management, collaborations between manufacturers and healthcare providers are likely to play a pivotal role in shaping the market's trajectory.

Key Players and Competitive Insights

Leading market players are investing majorly in research and development to spread their product lines, which will help the Insulin Pump market grow even more. The participants are also undertaking various strategic activities to spread their footprint with new market developments, including product launches, contractual agreements, mergers and acquisitions, major investments, and collaboration with other organizations. The Insulin Pump industry must offer cost-effective items to spread and survive in a competitive and rising market climate.

The players in the Insulin Pump market are attempting to raise market demand by investing in research and development operations, including Medtronic PLC, Hoffmann-La Roche Ltd., Tandem Diabetic Care, Inc., Insulet Corporation, Ypsomed, Cellenovo, Sooil Development, Valeritas, Inc., and Jingasu Delfu Co., Ltd.

Industry Developments

June 2022:Diabeloop, a leading company in therapeutic AI, and SOOIL Development Company, a leading company in superior diabetes therapy, Proposed an agreement for the development at the American Diabetes Association Scientific Sessions. It is anticipated that clinical trials will be established to spread their cooperation and provide access to their goods to as many plepeople as possible through new innovative products.

Market Segmentation

Outlook

- Hospitals & Clinics

- Homecare

- Laboratories

Insulin Pump Type Outlook

- Patch pumps

- Tethered pumps

Insulin Pump Product Outlook

- MiniMed

- Accu-Chek

- Tandem

- Omnipod

- My life omnipod

- Others

Insulin Pump End-user Outlook

- Hospitals & Clinics

- Homecare

- Laboratories

Insulin Pump Accessories Outlook

- Insulin reservoirs or cartridges

- Insulin set insertion devices

- Battery

Report Scope

| Report Attribute/Metric | Details |

| Market Size 2022 | USD 2.7 Billion |

| Market Size 2023 | USD 3.17 Billion |

| Market Size 2032 | USD 11.52 Billion |

| Compound Annual Growth Rate (CAGR) | 17.50% (2023-2032) |

| Base Year | 2022 |

| Market Forecast Period | 2023-2032 |

| Historical Data | 2018- 2022 |

| Market Forecast Units | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Type, Product, Accessories, End-user, and Region |

| Countries Covered | US |

| Key Companies Profiled | Medtronic PLC, Hoffmann-La Roche Ltd., Tandem Diabetic Care, Inc., Insulet Corporation, Ypsomed, Cellenovo, Sooil Development, Valeritas, Inc., and Jingasu Delfu Co., Ltd |

| Key Market Opportunities | Growth in awareness among healthcare professionals and people about the benefits of insulin pump therapy Rise in the focus on the prevention of diabetes globally |

| Key Market Dynamics | Growth in the adoption of closed-loop systems Rising preference among patients for insulin pumps |

FAQs

How much is the Insulin Pump market?

The US Insulin Pump market size was valued at USD 2.7 Billion in 2022.

What is the growth rate of the Insulin Pump market?

The market is projected to grow at a CAGR of 17.50% during the forecast period, 2023-2032.

Who are the key players in the Insulin Pump market?

The key players in the market are Medtronic PLC, Hoffmann-La Roche Ltd., Tandem Diabetic Care, Inc., Insulet Corporation, Ypsomed, Cellenovo, Sooil Development, Valeritas, Inc., and Jingasu Delfu Co., Ltd.

Which type led the Insulin Pump market?

The patch pumps category dominated the market in 2022.

Which product had the largest market share in the Insulin Pump market?

The MiniMed category had the largest share in the market.

Which accessories had the largest market share in the Insulin Pump market?

The insulin reservoirs or cartridges category had the largest share of the market.

Which end-use had the largest market share in the Insulin Pump market?

The hospitals & clinics category had the largest share of the market.

No infographic available

Kindly complete the form below to receive a free sample of this Report

Customer Stories

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”