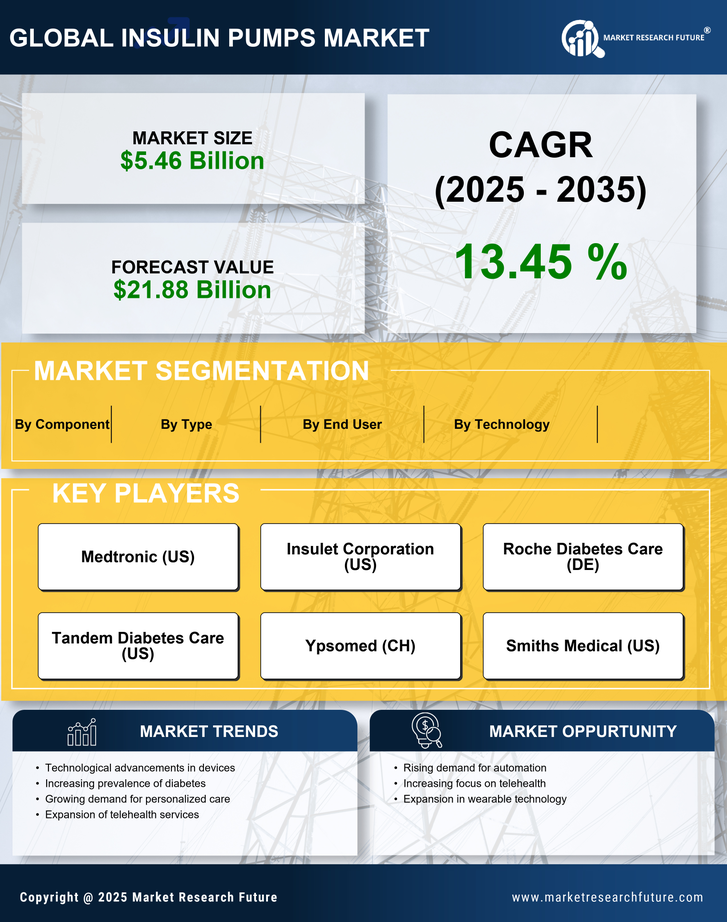

Rising Prevalence of Diabetes

The increasing incidence of diabetes worldwide is a primary driver for the Insulin Pumps Market. According to recent statistics, the number of individuals diagnosed with diabetes is projected to reach 700 million by 2045. This alarming trend necessitates effective management solutions, such as insulin pumps, which offer precise insulin delivery and improved glycemic control. As more patients seek advanced treatment options, the demand for insulin pumps is likely to surge. Furthermore, the growing awareness of diabetes management among healthcare professionals and patients alike contributes to the expansion of the Insulin Pumps Market. The need for innovative solutions to combat diabetes complications further emphasizes the importance of insulin pumps in modern healthcare.

Increasing Healthcare Expenditure

The rise in healthcare expenditure across various regions is propelling the Insulin Pumps Market. Governments and private sectors are investing more in diabetes care, recognizing the long-term benefits of effective management solutions. In many countries, healthcare spending on diabetes management is expected to increase by 5% annually, reflecting a growing commitment to improving patient outcomes. This financial support facilitates access to advanced treatment options, including insulin pumps, which are often more expensive than traditional insulin delivery methods. As healthcare systems prioritize chronic disease management, the Insulin Pumps Market is likely to benefit from increased funding and resources dedicated to diabetes care.

Growing Demand for Personalized Medicine

The shift towards personalized medicine is a notable driver for the Insulin Pumps Market. Patients are increasingly seeking tailored treatment plans that cater to their specific needs and lifestyles. Insulin pumps offer customizable settings, allowing users to adjust insulin delivery based on their daily activities, dietary habits, and glucose levels. This personalization enhances patient adherence and satisfaction, leading to better health outcomes. The market for personalized diabetes management solutions is projected to grow significantly, with insulin pumps playing a crucial role in this transformation. As healthcare providers embrace individualized treatment approaches, the Insulin Pumps Market is expected to expand in response to this demand.

Rising Awareness and Education Initiatives

The growing awareness of diabetes management and education initiatives is driving the Insulin Pumps Market. Various organizations and healthcare providers are actively promoting diabetes education, emphasizing the importance of effective management strategies. Increased awareness leads to higher rates of diagnosis and treatment, as patients become more informed about their options. In recent years, educational programs have reached millions, highlighting the benefits of insulin pumps in achieving better glycemic control. As more individuals recognize the advantages of using insulin pumps, the demand for these devices is likely to rise. This trend underscores the critical role of education in shaping the Insulin Pumps Market.

Technological Innovations in Insulin Delivery

Technological advancements in insulin delivery systems are significantly influencing the Insulin Pumps Market. Innovations such as smart insulin pumps, which integrate continuous glucose monitoring (CGM) systems, are enhancing patient experience and outcomes. These devices allow for real-time data analysis and automated insulin delivery adjustments, thereby reducing the risk of hypoglycemia and hyperglycemia. The market for insulin pumps is expected to grow as manufacturers invest in research and development to create more sophisticated devices. In 2023, the insulin pump segment accounted for approximately 30% of the overall diabetes care market, indicating a robust demand for these advanced technologies. As technology continues to evolve, the Insulin Pumps Market is poised for further growth.