Emergence of Smart Cities Initiatives

The emergence of smart cities initiatives in the United States is significantly shaping the infrastructure monitoring market. As urban areas strive to become more efficient and sustainable, the integration of smart technologies into infrastructure is becoming essential. These initiatives often involve the deployment of advanced monitoring systems that provide real-time data on various infrastructure components. The market is expected to witness substantial growth as cities invest in these technologies to enhance urban living conditions. This trend suggests a promising future for the infrastructure monitoring market as smart city projects gain momentum.

Growing Awareness of Asset Management

The infrastructure monitoring market is benefiting from a growing awareness of the importance of asset management among organizations. Companies are increasingly recognizing that proactive monitoring can lead to cost savings and improved operational efficiency. By implementing monitoring solutions, organizations can identify potential issues before they escalate, thereby reducing maintenance costs by up to 30%. This shift in mindset is likely to drive demand for infrastructure monitoring solutions, as businesses seek to optimize their asset management strategies and ensure the longevity of their infrastructure.

Rising Concerns Over Infrastructure Safety

Safety concerns regarding aging infrastructure are becoming more pronounced in the United States, thereby influencing the infrastructure monitoring market. High-profile incidents, such as bridge collapses and road failures, have heightened public awareness and prompted calls for enhanced monitoring systems. As a result, government agencies and private organizations are increasingly investing in monitoring technologies to ensure compliance with safety standards. This trend indicates a growing market for infrastructure monitoring solutions, as stakeholders prioritize safety and risk mitigation in their infrastructure management strategies.

Increased Investment in Infrastructure Projects

In the United States, there is a notable increase in investment in infrastructure projects, which is significantly impacting the infrastructure monitoring market. The Biden administration's infrastructure plan allocates $1.2 trillion for various projects, including roads, bridges, and public transit systems. This influx of funding is expected to create a robust demand for monitoring solutions to ensure the safety and longevity of these assets. As infrastructure projects expand, the need for effective monitoring systems becomes paramount, suggesting a strong growth trajectory for the infrastructure monitoring market in the coming years.

Technological Advancements in Monitoring Solutions

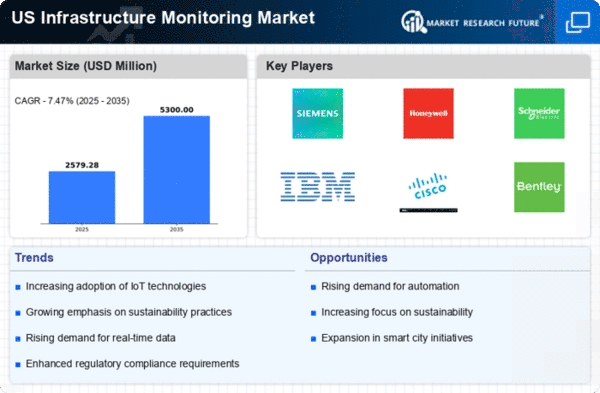

The infrastructure monitoring market is experiencing a surge due to rapid technological advancements. Innovations in sensor technology, data analytics, and artificial intelligence are enhancing the capabilities of monitoring systems. For instance, the integration of IoT devices allows for real-time data collection and analysis, which is crucial for maintaining infrastructure integrity. The market is projected to grow at a CAGR of approximately 12% from 2025 to 2030, driven by these advancements. As organizations increasingly adopt smart technologies, the demand for sophisticated monitoring solutions is likely to rise, thereby propelling the infrastructure monitoring market forward.