Emergence of 5G Technology

The advent of 5G technology is poised to revolutionize the US Industrial Communication Market. With its promise of ultra-reliable low-latency communication, 5G enables real-time data transmission and enhances connectivity among industrial devices. This technological advancement is expected to facilitate the deployment of smart factories and IoT applications, which rely heavily on robust communication networks. Industry analysts predict that the 5G market in the US could reach USD 300 billion by 2025, underscoring its potential impact on industrial communication. As manufacturers seek to leverage the benefits of 5G, the demand for compatible communication solutions is likely to surge, driving innovation and growth in the market.

Regulatory Compliance and Standards

The US Industrial Communication Market is significantly influenced by regulatory compliance and standards that govern industrial operations. Various federal and state regulations mandate the implementation of specific communication protocols to ensure safety and efficiency in manufacturing environments. For example, the National Institute of Standards and Technology (NIST) has established guidelines that promote secure and efficient communication in industrial settings. Compliance with these regulations often necessitates the adoption of advanced communication technologies, thereby driving market growth. As companies strive to meet these standards, the demand for reliable industrial communication solutions is expected to increase, further shaping the market landscape.

Growth of Smart Manufacturing Initiatives

The US Industrial Communication Market is experiencing a notable surge due to the growth of smart manufacturing initiatives. These initiatives, driven by the need for increased efficiency and productivity, leverage advanced communication technologies to facilitate real-time data exchange. According to recent data, the smart manufacturing sector is projected to reach USD 500 billion by 2026, indicating a robust demand for industrial communication solutions. This growth is further supported by government policies promoting automation and digital transformation in manufacturing processes. As companies adopt smart technologies, the need for reliable and efficient communication systems becomes paramount, thereby driving the market for industrial communication solutions.

Increased Focus on Operational Efficiency

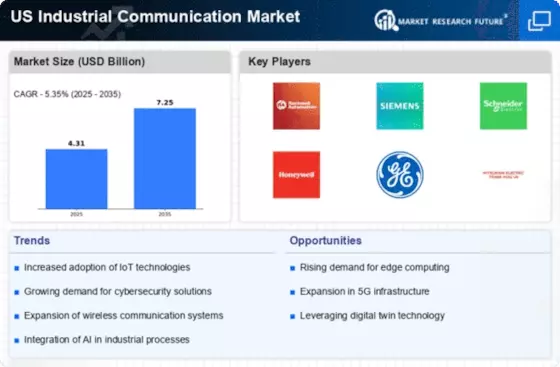

In the US Industrial Communication Market, there is an increasing focus on operational efficiency among manufacturers. Companies are striving to optimize their processes to reduce costs and enhance productivity. This trend is reflected in the growing investment in communication technologies that enable seamless integration of machinery and systems. For instance, the market for industrial communication devices is expected to grow at a CAGR of 8% from 2023 to 2028. Enhanced communication systems facilitate better monitoring and control of operations, leading to improved decision-making and resource allocation. As manufacturers seek to streamline their operations, the demand for advanced industrial communication solutions is likely to rise.

Rising Demand for Remote Monitoring Solutions

The US Industrial Communication Market is witnessing a rising demand for remote monitoring solutions, driven by the need for enhanced operational visibility and control. Manufacturers are increasingly adopting remote monitoring technologies to oversee their operations from anywhere, ensuring timely responses to potential issues. This trend is supported by the growing adoption of cloud-based communication platforms, which facilitate real-time data access and analysis. According to market forecasts, the remote monitoring market is expected to grow at a CAGR of 10% through 2026. As companies prioritize efficiency and responsiveness, the demand for advanced industrial communication solutions that support remote monitoring is likely to expand, shaping the future of the industry.