Focus on Workforce Augmentation

The industrial AI market is increasingly focusing on workforce augmentation. AI technologies are being employed to enhance human capabilities rather than replace them. This approach is particularly relevant in sectors facing labor shortages and skills gaps. By utilizing AI tools, companies can empower their workforce with advanced analytics and decision-support systems, leading to improved productivity and job satisfaction. Research indicates that organizations that adopt AI for workforce augmentation can see productivity gains of up to 40%. This trend not only addresses immediate operational challenges but also fosters a culture of innovation and continuous improvement within the industrial ai market.

Integration of IoT and AI Technologies

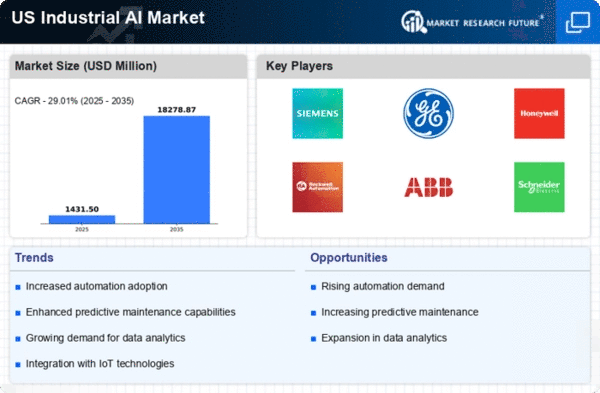

The convergence of Internet of Things (IoT) and artificial intelligence (AI) is significantly influencing the industrial ai market. As more devices become interconnected, the volume of data generated is immense, necessitating advanced AI solutions for effective analysis. This integration allows for real-time monitoring and decision-making, enhancing productivity and reducing operational costs. In fact, it is projected that the IoT market will reach $1 trillion by 2025, with a substantial portion of this growth attributed to AI applications. The ability to harness data from IoT devices empowers industries to optimize processes and improve product quality, thereby driving the demand for AI-driven solutions in the industrial ai market.

Rising Demand for Predictive Maintenance

The industrial ai market is experiencing a notable surge in demand for predictive maintenance solutions. This trend is driven by the need for manufacturers to minimize downtime and enhance operational efficiency. By leveraging AI algorithms, companies can analyze equipment data in real-time, predicting failures before they occur. According to recent estimates, predictive maintenance can reduce maintenance costs by up to 30% and increase equipment lifespan by 20%. As industries increasingly recognize the value of proactive maintenance strategies, The industrial AI market is expected to experience substantial growth, with investments in AI technologies projected to reach $10 billion by 2026. This shift towards predictive maintenance not only optimizes resource allocation but also aligns with broader trends in operational excellence within the industrial ai market.

Investment in AI Research and Development

Investment in research and development (R&D) for AI technologies is a pivotal driver of growth in the industrial ai market. Companies are increasingly allocating resources to innovate and develop advanced AI solutions tailored to specific industrial applications. This trend is supported by government initiatives aimed at fostering technological advancements and enhancing competitiveness. In 2025, it is anticipated that R&D spending in AI will exceed $15 billion, reflecting a commitment to harnessing AI's potential across various sectors. This investment not only accelerates the development of cutting-edge technologies but also positions the industrial ai market as a leader in the global technological landscape.

Regulatory Compliance and Safety Enhancements

Regulatory compliance and safety enhancements are becoming critical drivers in the industrial ai market. As industries face increasing scrutiny regarding safety standards and environmental regulations, AI technologies are being deployed to ensure compliance and mitigate risks. AI can analyze vast amounts of data to identify potential safety hazards and ensure adherence to regulations, thereby reducing liability and enhancing workplace safety. The market for compliance-related AI solutions is expected to grow significantly, with estimates suggesting a potential increase of 25% in demand over the next few years. This focus on compliance not only protects organizations but also contributes to the overall integrity of the industrial ai market.