Expansion of E-commerce Platforms

The rise of e-commerce platforms is significantly influencing the North America Industrial Chocolate Market. With the increasing preference for online shopping, particularly post-pandemic, chocolate manufacturers are leveraging digital channels to reach a broader audience. Data indicates that online sales of chocolate products have surged, with e-commerce accounting for nearly 20% of total chocolate sales in North America. This shift not only provides convenience for consumers but also allows manufacturers to showcase a wider range of products, including artisanal and specialty chocolates. As e-commerce continues to expand, the North America Industrial Chocolate Market is likely to see enhanced sales and brand visibility, fostering competition among traditional retailers and online platforms.

Innovations in Product Development

Innovation plays a crucial role in shaping the North America Industrial Chocolate Market. Manufacturers are increasingly investing in research and development to create unique chocolate products that cater to evolving consumer tastes. This includes the introduction of functional chocolates infused with health benefits, such as added vitamins or superfoods. Recent market analysis suggests that the functional chocolate segment is expected to grow by over 6% annually, reflecting a shift towards healthier indulgence. Additionally, advancements in production technology are enabling manufacturers to enhance product quality and reduce costs. As a result, the North America Industrial Chocolate Market is poised for growth, driven by continuous innovation and the introduction of novel products.

Rising Interest in Sustainable Practices

Sustainability has emerged as a pivotal driver in the North America Industrial Chocolate Market. Consumers are increasingly concerned about the environmental impact of their purchases, prompting manufacturers to adopt sustainable sourcing and production practices. This trend is reflected in the growing demand for ethically sourced cocoa, with a significant portion of consumers willing to pay a premium for products that meet sustainability standards. Recent surveys indicate that approximately 60% of North American consumers prioritize sustainability when purchasing chocolate. Consequently, companies that embrace sustainable practices are likely to gain a competitive edge in the market. The North America Industrial Chocolate Market is thus adapting to these consumer preferences, fostering a more responsible and eco-friendly approach to chocolate production.

Growing Demand for Confectionery Products

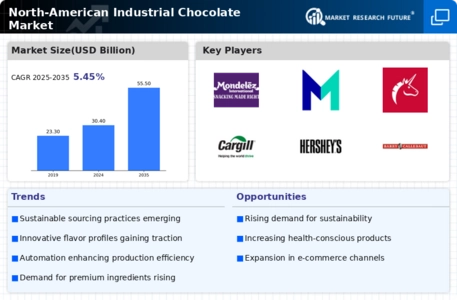

The North America Industrial Chocolate Market is experiencing a notable increase in demand for confectionery products. This surge is driven by changing consumer preferences, particularly among younger demographics who favor innovative and indulgent chocolate offerings. According to recent data, the confectionery sector in North America is projected to grow at a compound annual growth rate (CAGR) of approximately 4.5% over the next five years. This growth is likely to be fueled by the introduction of new flavors and formats, as well as the expansion of distribution channels. As manufacturers respond to this demand, the North America Industrial Chocolate Market is expected to benefit from enhanced production capabilities and product diversification, ultimately leading to increased market share and profitability.

Regulatory Support for Food Safety Standards

Regulatory frameworks play a vital role in the North America Industrial Chocolate Market, particularly concerning food safety standards. Government agencies, such as the Food and Drug Administration (FDA), enforce stringent regulations that ensure the safety and quality of chocolate products. Compliance with these regulations not only protects consumers but also enhances the credibility of manufacturers. Recent updates to food safety guidelines have prompted companies to invest in quality assurance processes, thereby improving product integrity. As the regulatory landscape evolves, the North America Industrial Chocolate Market is likely to benefit from increased consumer trust and loyalty, ultimately driving market growth and stability.