Regulatory Support and Compliance

The US In Vehicle Video Surveillance Market benefits from robust regulatory support aimed at enhancing public safety and security. Federal and state regulations increasingly mandate the use of video surveillance in commercial vehicles, particularly in public transportation and school buses. For instance, the Federal Motor Carrier Safety Administration has implemented guidelines that encourage the adoption of surveillance systems to monitor driver behavior and ensure compliance with safety standards. This regulatory framework not only promotes the use of surveillance technology but also provides a competitive edge to companies that invest in these systems. As compliance becomes a critical factor for fleet operators, the market is likely to see a rise in demand for advanced surveillance solutions that meet regulatory requirements.

Increased Demand for Safety Solutions

The US In Vehicle Video Surveillance Market is witnessing a heightened demand for safety solutions, driven by growing concerns over road safety and security. Fleet operators and transportation companies are increasingly recognizing the value of video surveillance in mitigating risks associated with accidents and theft. According to industry reports, nearly 70% of fleet managers indicate that video surveillance systems have significantly reduced incidents of fraud and false claims. This trend is further supported by the rising number of commercial vehicles on the road, which necessitates enhanced monitoring capabilities. As public awareness of safety issues continues to rise, the market is expected to expand, with more organizations investing in comprehensive surveillance systems to protect their assets and ensure the safety of their drivers.

Integration with Smart City Initiatives

The US In Vehicle Video Surveillance Market is increasingly aligning with smart city initiatives that aim to enhance urban safety and efficiency. As cities across the United States invest in smart infrastructure, the integration of vehicle surveillance systems with city-wide monitoring networks becomes more prevalent. This integration allows for real-time data sharing between vehicles and city management systems, facilitating improved traffic management and emergency response. For example, cities like San Francisco and New York are implementing smart traffic solutions that incorporate vehicle surveillance data to optimize traffic flow and enhance public safety. This trend not only supports the growth of the surveillance market but also positions it as a critical component of future urban planning and development.

Growing Adoption in Public Transportation

The US In Vehicle Video Surveillance Market is experiencing a notable increase in the adoption of surveillance systems within public transportation. Transit agencies are recognizing the importance of video surveillance in ensuring passenger safety and deterring criminal activity. Recent statistics indicate that over 80% of public transit systems in major US cities have implemented some form of video surveillance. This trend is driven by the need to enhance security measures in response to rising concerns about safety in public spaces. Additionally, the availability of funding from federal and state programs aimed at improving public transportation infrastructure further supports this growth. As agencies continue to prioritize safety, the demand for advanced surveillance solutions in public transportation is expected to rise.

Technological Advancements in Surveillance Systems

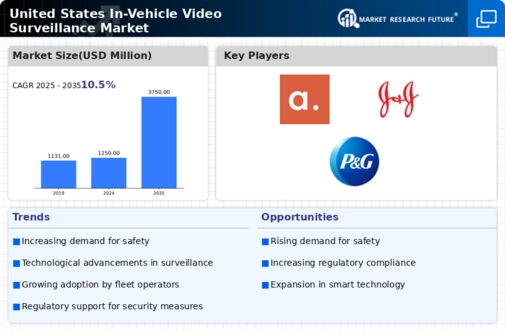

The US In Vehicle Video Surveillance Market is experiencing a surge in technological advancements, particularly in high-definition cameras and real-time data transmission. These innovations enhance the clarity and reliability of video footage, which is crucial for law enforcement and fleet management. The integration of artificial intelligence and machine learning algorithms into surveillance systems allows for advanced analytics, such as facial recognition and behavior analysis. This capability not only improves security but also aids in accident reconstruction and liability assessment. As a result, the market is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 10% in the coming years. The adoption of cloud-based storage solutions further supports this growth, enabling easier access and management of video data across various platforms.