Rising Geriatric Population

The growing geriatric population in the US is a significant factor driving the hemodynamic monitoring-systems market. As individuals age, they are more susceptible to various health issues, including cardiovascular diseases and hypertension. The US Census Bureau projects that by 2030, all baby boomers will be over 65, leading to an increased demand for healthcare services. This demographic shift necessitates the implementation of effective monitoring systems to manage the health of older adults. Healthcare providers are likely to invest in hemodynamic monitoring technologies to ensure timely interventions and improve patient outcomes. Consequently, the hemodynamic monitoring-systems market is expected to experience substantial growth as the healthcare sector adapts to the needs of an aging population.

Focus on Patient-Centric Care

The shift towards patient-centric care is reshaping the hemodynamic monitoring-systems market. Healthcare providers are increasingly prioritizing personalized treatment plans that cater to individual patient needs. This approach necessitates the use of advanced monitoring systems that provide accurate and timely data on patients' hemodynamic status. By leveraging these technologies, clinicians can make informed decisions, leading to improved patient outcomes and satisfaction. The emphasis on patient-centric care is likely to drive the adoption of hemodynamic monitoring systems, as healthcare facilities seek to enhance their service offerings. This trend indicates a growing recognition of the importance of tailored healthcare solutions, which could significantly impact the market's growth trajectory.

Government Initiatives and Funding

Government initiatives and funding aimed at improving healthcare infrastructure are pivotal in driving the hemodynamic monitoring-systems market. Various federal and state programs are designed to enhance healthcare delivery and promote the adoption of advanced medical technologies. For instance, funding for research and development in medical devices has increased, encouraging innovation in hemodynamic monitoring systems. Additionally, initiatives that support the integration of technology in healthcare settings are likely to boost market growth. As healthcare providers receive financial support to upgrade their monitoring capabilities, the demand for sophisticated hemodynamic monitoring systems is expected to rise. This trend underscores the role of government policies in shaping the future landscape of the hemodynamic monitoring-systems market.

Increasing Prevalence of Cardiovascular Diseases

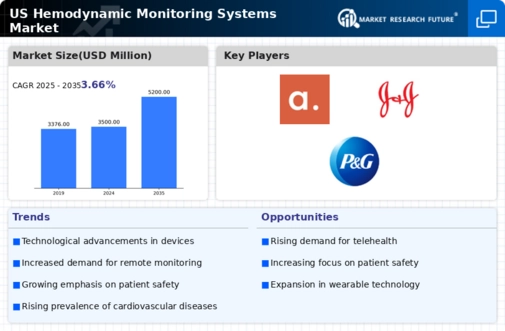

The rising incidence of cardiovascular diseases in the US is a primary driver for the hemodynamic monitoring-systems market. According to the American Heart Association, cardiovascular diseases account for approximately 697,000 deaths annually, highlighting the urgent need for effective monitoring solutions. As healthcare providers seek to enhance patient outcomes, the demand for advanced hemodynamic monitoring systems is expected to grow. These systems facilitate real-time assessment of cardiac function, enabling timely interventions. The market is projected to expand as hospitals and clinics invest in these technologies to improve patient care and reduce mortality rates associated with cardiovascular conditions. This trend indicates a robust growth trajectory for the hemodynamic monitoring-systems market, as healthcare systems prioritize the management of cardiovascular health.

Technological Advancements in Monitoring Devices

Technological innovations are significantly influencing the hemodynamic monitoring-systems market. The introduction of sophisticated devices, such as portable and wireless monitoring systems, enhances the ability to track patients' hemodynamic status in real-time. These advancements allow for continuous monitoring, which is crucial in critical care settings. The market is witnessing a shift towards devices that integrate advanced features, such as cloud connectivity and data analytics, which improve the accuracy and efficiency of monitoring. As healthcare facilities adopt these cutting-edge technologies, the demand for hemodynamic monitoring systems is likely to increase. The market's growth is further supported by the need for improved patient management and the reduction of hospital stays, which can lead to cost savings for healthcare providers.