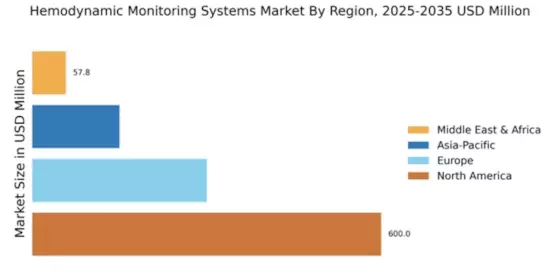

North America : Market Leader in Innovation

North America continues to lead the Hemodynamic Monitoring Systems market, holding a significant share of 600.0M in 2024. The growth is driven by increasing prevalence of cardiovascular diseases, advancements in technology, and a robust healthcare infrastructure. Regulatory support from agencies like the FDA has also catalyzed innovation, ensuring that new products meet stringent safety and efficacy standards. The demand for real-time monitoring solutions is rising, further propelling market expansion.

The United States is the primary contributor to this market, with key players such as Edwards Lifesciences, Medtronic, and GE Healthcare dominating the landscape. The competitive environment is characterized by continuous innovation and strategic partnerships aimed at enhancing product offerings. As healthcare providers increasingly adopt advanced monitoring systems, the market is expected to maintain its upward trajectory, solidifying North America's position as a global leader.

Europe : Emerging Market with Growth Potential

Europe's Hemodynamic Monitoring Systems market is valued at 300.0M, reflecting a growing demand for advanced monitoring solutions. The region benefits from a strong regulatory framework that encourages innovation and ensures patient safety. Initiatives by the European Medicines Agency (EMA) to streamline approval processes for new technologies are expected to further boost market growth. The increasing incidence of chronic diseases and an aging population are also significant drivers of demand in this sector.

Leading countries in this market include Germany, France, and the UK, where major players like Philips and Siemens Healthineers are actively expanding their product lines. The competitive landscape is marked by collaborations and mergers aimed at enhancing technological capabilities. As healthcare systems evolve, the focus on patient-centered care is likely to drive further adoption of hemodynamic monitoring systems across Europe.

Asia-Pacific : Rapidly Growing Market Segment

The Asia-Pacific region, with a market size of 150.0M, is witnessing rapid growth in the Hemodynamic Monitoring Systems sector. Factors such as rising healthcare expenditure, increasing awareness of cardiovascular diseases, and government initiatives to improve healthcare infrastructure are driving this growth. The demand for advanced monitoring systems is also being fueled by the rising number of surgical procedures and the need for real-time patient monitoring solutions.

Countries like Japan, China, and India are leading the charge, with significant investments from key players such as Nihon Kohden and Getinge. The competitive landscape is evolving, with local manufacturers emerging alongside established global players. As healthcare systems in the region continue to modernize, the adoption of hemodynamic monitoring technologies is expected to accelerate, positioning Asia-Pacific as a vital market for future growth.

Middle East and Africa : Emerging Market with Challenges

The Middle East and Africa (MEA) region, valued at 57.81M, presents a unique landscape for the Hemodynamic Monitoring Systems market. The growth is primarily driven by increasing healthcare investments and a rising prevalence of chronic diseases. However, regulatory challenges and varying healthcare standards across countries can hinder market expansion. Governments are increasingly focusing on improving healthcare infrastructure, which is expected to create opportunities for advanced monitoring solutions in the coming years.

Countries like South Africa and the UAE are at the forefront of this market, with key players like Deltex Medical making strides in the region. The competitive environment is characterized by a mix of local and international companies striving to meet the growing demand for innovative healthcare solutions. As the region continues to develop, the adoption of hemodynamic monitoring systems is likely to gain momentum, despite existing challenges.