Expansion of Retail Channels

The expansion of retail channels is significantly influencing the hair supplements market. Traditional brick-and-mortar stores are increasingly complemented by online platforms, providing consumers with a wider array of purchasing options. The convenience of e-commerce, coupled with the ability to access customer reviews and product information, appears to enhance consumer confidence in purchasing hair supplements. Data indicates that online sales of hair supplements have surged by over 25% in recent years, reflecting a shift in shopping behavior. The hair supplements market is thus adapting to this trend by optimizing their online presence and ensuring that products are readily available across multiple platforms. This diversification not only increases accessibility but also allows brands to reach a broader audience, potentially boosting overall sales.

Increasing Awareness of Hair Health

The growing awareness regarding hair health among consumers is a pivotal driver for the hair supplements market. As individuals become more conscious of the impact of nutrition on hair quality, the demand for supplements that promote hair growth and strength is likely to rise. Reports indicate that approximately 40% of consumers actively seek products that enhance hair vitality. This trend is particularly pronounced among millennials and Gen Z, who prioritize self-care and wellness. The hair supplements market is thus witnessing a surge in product offerings that cater to this demographic, including vegan and organic options. Furthermore, educational campaigns by brands about the benefits of specific vitamins and minerals for hair health are contributing to this heightened awareness, potentially leading to increased sales and market expansion.

Focus on Preventive Health and Wellness

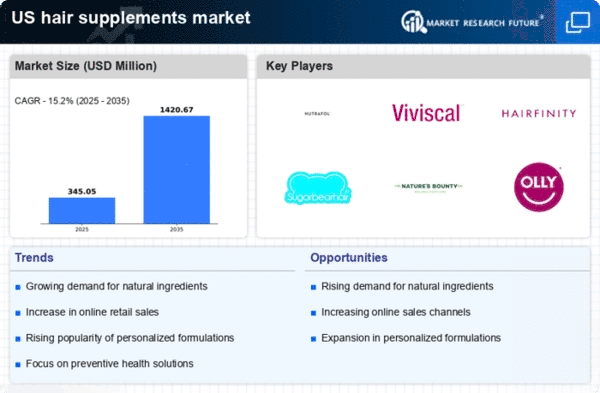

The growing emphasis on preventive health and wellness is emerging as a significant driver for the hair supplements market. Consumers are increasingly seeking proactive solutions to maintain their overall health, including hair health. This trend is reflected in the rising popularity of supplements that not only promote hair growth but also contribute to overall well-being. Research indicates that the wellness supplement market has seen a growth rate of approximately 15% annually, with hair supplements being a notable segment. The hair supplements market is capitalizing on this trend by formulating products that combine hair health with other health benefits, such as improved skin and nail health. This holistic approach is likely to attract health-conscious consumers, further propelling market growth.

Rising Incidence of Hair Loss Conditions

The increasing prevalence of hair loss conditions among various demographics is a critical driver for the hair supplements market. Factors such as stress, hormonal changes, and environmental influences contribute to hair thinning and loss, affecting both men and women. Recent studies indicate that nearly 50% of women and 40% of men experience some form of hair loss by the age of 50. This alarming trend has led to a heightened demand for effective hair supplements that promise to combat these issues. The hair supplements market is responding by developing targeted formulations that address specific types of hair loss, such as androgenetic alopecia. As awareness of these conditions grows, consumers are more inclined to invest in supplements that offer potential solutions, thereby driving market growth.

Influence of Social Media and Celebrity Endorsements

The influence of social media and celebrity endorsements plays a significant role in shaping consumer preferences within the hair supplements market. Platforms such as Instagram and TikTok have become vital channels for brands to showcase their products, often through influencer partnerships. This marketing strategy appears to resonate particularly well with younger audiences, who are more likely to trust recommendations from social media personalities. Data suggests that products endorsed by celebrities can experience sales increases of up to 30%. As a result, the hair supplements market is adapting to this trend by investing in digital marketing strategies that leverage social media engagement. This shift not only enhances brand visibility but also fosters a community around hair care, encouraging consumers to share their experiences and results.