Growing Demand for Specialty Diets

The gluten free-foods-beverages market is experiencing growth due to the rising popularity of specialty diets, such as paleo and keto, which often emphasize gluten-free options. As consumers increasingly seek diets that align with their health goals, the demand for gluten-free products has expanded beyond those with gluten sensitivities. Market data suggests that nearly 25% of consumers in the US are actively trying to reduce gluten in their diets, regardless of medical necessity. This trend is prompting food manufacturers to innovate and create gluten-free alternatives that cater to diverse dietary preferences. The gluten free-foods-beverages market is thus positioned to capitalize on this trend, as more consumers embrace gluten-free options as part of their overall health and wellness strategies.

Rising Awareness of Celiac Disease

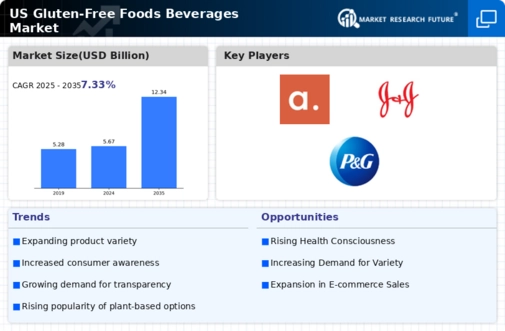

The increasing awareness of celiac disease and gluten intolerance is a pivotal driver for the gluten free-foods-beverages market. As more individuals are diagnosed with celiac disease, which affects approximately 1 in 100 people in the US, the demand for gluten-free products has surged. This heightened awareness has led to a significant shift in consumer preferences, with many opting for gluten-free options even if they do not have a medical necessity. The gluten free-foods-beverages market is projected to grow at a CAGR of around 9% through 2026, indicating a robust response to this growing awareness. Retailers are expanding their gluten-free offerings, catering to a broader audience that includes health-conscious consumers and those seeking dietary alternatives.

Increased Availability in Retail Channels

The expansion of gluten-free products across various retail channels is a crucial driver for the gluten free-foods-beverages market. Supermarkets, health food stores, and online platforms are increasingly stocking gluten-free options, making them more accessible to consumers. This trend is supported by data indicating that over 30% of US households now purchase gluten-free products regularly. The convenience of finding gluten-free items in mainstream grocery stores has contributed to a rise in consumer adoption. Furthermore, the gluten free-foods-beverages market is benefiting from collaborations between manufacturers and retailers, enhancing product visibility and availability. As more brands enter the market, competition is likely to drive innovation and improve product quality, further stimulating consumer interest.

Influence of Social Media and Health Trends

The impact of social media on dietary choices is a notable driver for the gluten free-foods-beverages market. Platforms like Instagram and TikTok have popularized gluten-free lifestyles, with influencers promoting gluten-free recipes and products. This visibility has led to increased consumer interest and experimentation with gluten-free foods. Data indicates that social media campaigns can boost product sales by up to 20%, highlighting the effectiveness of digital marketing in shaping consumer behavior. As more individuals share their gluten-free experiences online, the gluten free-foods-beverages market is likely to see sustained growth, driven by peer recommendations and the desire for healthier eating habits.

Regulatory Support for Gluten-Free Labeling

Regulatory frameworks supporting gluten-free labeling are essential drivers for the gluten free-foods-beverages market. The US Food and Drug Administration (FDA) has established clear guidelines for gluten-free labeling, which helps consumers make informed choices. This regulatory clarity not only protects consumers but also encourages manufacturers to develop gluten-free products that meet these standards. As a result, the gluten free-foods-beverages market is witnessing an influx of new products that comply with FDA regulations, enhancing consumer trust. The presence of certified gluten-free labels can increase product sales by approximately 15%, as consumers are more likely to purchase items that are clearly marked as gluten-free.