Increasing Muslim Population

The halal foods-beverages market is experiencing growth driven by the increasing Muslim population in the United States. As of 2025, the Muslim demographic is projected to reach approximately 3.85 million, representing about 1.1% of the total U.S. population. This demographic shift is likely to enhance demand for halal-certified products, as consumers seek food and beverage options that align with their dietary laws. The halal foods-beverages market is thus positioned to benefit from this expanding consumer base, as businesses adapt their offerings to meet the needs of this growing population. Furthermore, the increasing visibility of halal products in mainstream retail channels may further stimulate interest and consumption among non-Muslim consumers, potentially broadening the market's appeal.

Health Consciousness Among Consumers

There is a notable trend towards health consciousness among consumers, which is influencing the halal foods-beverages market. Many consumers perceive halal products as healthier options due to the stringent regulations surrounding their production. For instance, halal meat is often associated with higher animal welfare standards and the absence of certain additives. This perception is supported by market data indicating that the organic and natural food sectors have seen substantial growth, with the organic food market alone reaching $62 billion in 2024. As health awareness continues to rise, the halal foods-beverages market is likely to attract a broader audience, including those who prioritize health and wellness in their dietary choices.

Culinary Diversity and Fusion Cuisine

Culinary diversity is becoming increasingly prominent in the U.S., with consumers showing a growing interest in fusion cuisine that incorporates halal ingredients. This trend is likely to enhance the appeal of the halal foods-beverages market, as chefs and food manufacturers experiment with innovative recipes that blend traditional halal foods with various culinary styles. The halal foods-beverages market can capitalize on this trend by promoting unique product offerings that cater to adventurous eaters. As the demand for diverse culinary experiences continues to rise, the market may see an influx of new products that attract both Muslim and non-Muslim consumers alike.

E-commerce Growth and Online Retailing

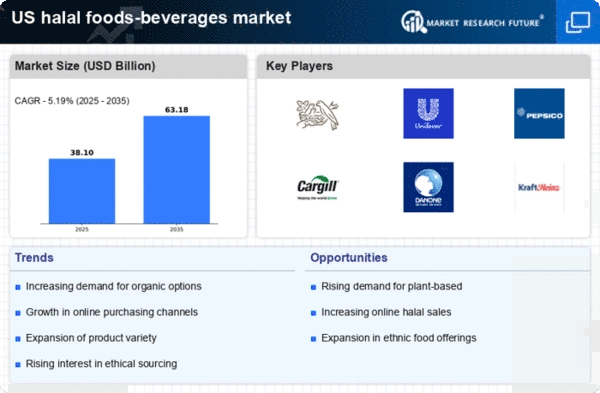

The rise of e-commerce is significantly impacting the halal foods-beverages market, as more consumers turn to online platforms for their grocery shopping. In 2025, online grocery sales in the U.S. are expected to surpass $100 billion, reflecting a shift in consumer purchasing behavior. This trend presents an opportunity for halal food brands to expand their reach and accessibility through digital channels. The halal foods-beverages market can leverage this growth by enhancing online visibility and offering convenient delivery options. Additionally, the ability to provide detailed product information and certifications online may further instill consumer confidence, thereby driving sales in this segment.

Regulatory Support and Certification Standards

Regulatory support and the establishment of certification standards are crucial drivers for the halal foods-beverages market. In the U.S., organizations are working to create clear guidelines for halal certification, which can enhance consumer trust and market credibility. As of 2025, the presence of recognized certification bodies is expected to increase, providing assurance to consumers regarding the authenticity of halal products. This regulatory framework is likely to facilitate market growth by encouraging more producers to enter the halal foods-beverages market. Furthermore, as consumers become more aware of certification processes, the demand for certified products may rise, further solidifying the market's foundation.