Rising Healthcare Expenditure

The upward trend in healthcare expenditure in the US is contributing to the expansion of the glucose tolerance-test market. With healthcare spending projected to reach $6.2 trillion by 2028, there is a growing allocation of resources towards diagnostic testing and preventive care. This increase in funding allows for better access to glucose tolerance tests, as healthcare providers invest in advanced testing technologies and patient education initiatives. Moreover, as insurance coverage for preventive screenings expands, more individuals are likely to undergo glucose tolerance testing. This financial support is expected to bolster the glucose tolerance-test market, making it a vital component of diabetes management and prevention strategies.

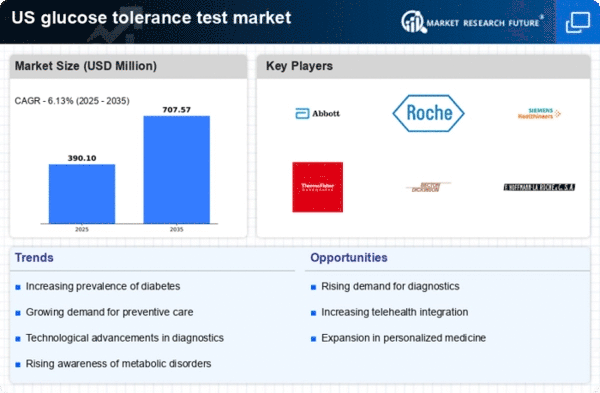

Increasing Diabetes Prevalence

The rising incidence of diabetes in the US is a primary driver for the glucose tolerance-test market. According to the Centers for Disease Control and Prevention (CDC), approximately 34.2 million Americans, or 10.5% of the population, have diabetes. This alarming statistic underscores the necessity for effective screening and diagnostic tools, such as glucose tolerance tests, to manage and monitor the condition. As the prevalence of prediabetes and type 2 diabetes continues to escalate, healthcare providers are increasingly relying on glucose tolerance tests to identify at-risk individuals. The glucose tolerance-test market is thus poised for growth, as more patients seek early diagnosis and intervention to prevent the progression of diabetes.

Growing Focus on Preventive Healthcare

The increasing emphasis on preventive healthcare is a notable driver for the glucose tolerance-test market. As healthcare systems shift towards preventive measures, the demand for early detection of metabolic disorders, including diabetes, is on the rise. This trend is reflected in the growing number of health screenings and wellness programs offered by employers and healthcare providers. The glucose tolerance-test market stands to gain from this shift, as more individuals seek proactive measures to monitor their health. In 2023, the preventive healthcare market in the US was valued at approximately $50 billion, indicating a robust interest in early intervention strategies. This focus on prevention is likely to sustain the growth of the glucose tolerance-test market in the coming years.

Advancements in Diagnostic Technologies

Innovations in diagnostic technologies are significantly influencing the glucose tolerance-test market. The development of more accurate and efficient testing methods, such as continuous glucose monitoring systems and point-of-care testing devices, enhances the ability to diagnose glucose metabolism disorders. These advancements not only improve patient outcomes but also streamline the testing process, making it more accessible. The glucose tolerance-test market is likely to benefit from these technological improvements, as they facilitate quicker and more reliable results. Furthermore, the integration of digital health solutions, including mobile applications for tracking glucose levels, is expected to drive demand for glucose tolerance tests, as patients become more engaged in their health management.

Increased Awareness of Metabolic Disorders

The heightened awareness of metabolic disorders among the US population is driving the glucose tolerance-test market. Educational campaigns and public health initiatives have successfully informed individuals about the risks associated with conditions like diabetes and insulin resistance. As a result, more people are seeking testing to understand their glucose levels and overall metabolic health. This trend is reflected in the rising number of glucose tolerance tests conducted annually, which has increased by approximately 15% over the past five years. The glucose tolerance-test market is likely to continue benefiting from this growing awareness, as individuals prioritize their health and seek out diagnostic tools to manage their risk of developing serious health issues.