Rising Incidence of Obesity

The rising incidence of obesity is a critical factor influencing the Glucose Tolerance Test Market. Obesity is a well-established risk factor for the development of type 2 diabetes, and as obesity rates continue to climb, the demand for glucose tolerance testing is likely to increase. Health organizations have reported alarming trends in obesity prevalence, which correlates with a rise in diabetes cases. This relationship underscores the importance of glucose tolerance testing as a preventive measure. Consequently, the Glucose Tolerance Test Market is expected to experience growth as healthcare providers focus on screening obese individuals to identify those at risk for diabetes.

Increased Government Initiatives

Government initiatives aimed at combating diabetes are increasingly influencing the Glucose Tolerance Test Market. Various health organizations and governmental bodies are implementing programs designed to promote diabetes screening and prevention. For instance, initiatives that subsidize testing costs or provide free screenings in community health settings are becoming more prevalent. Such measures not only enhance accessibility but also encourage individuals to undergo glucose tolerance testing. The World Health Organization has reported that diabetes prevalence is expected to rise, prompting governments to take action. This proactive approach is likely to bolster the Glucose Tolerance Test Market, as more individuals are encouraged to participate in testing.

Rising Awareness of Diabetes Management

The increasing awareness surrounding diabetes management is a pivotal driver for the Glucose Tolerance Test Market. As educational initiatives proliferate, individuals are becoming more cognizant of the importance of early detection and management of diabetes. This heightened awareness is likely to lead to an uptick in the number of individuals seeking glucose tolerance testing, thereby expanding the market. Reports indicate that approximately 463 million adults were living with diabetes in 2019, a figure projected to rise significantly. Consequently, the Glucose Tolerance Test Market is poised to benefit from this growing demographic, as healthcare providers emphasize the necessity of regular testing to mitigate the risks associated with diabetes.

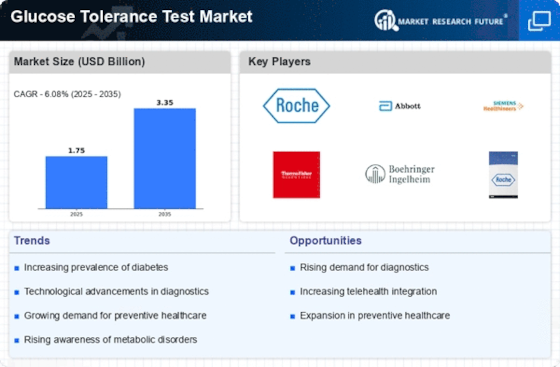

Growing Demand for Preventive Healthcare

The shift towards preventive healthcare is a significant driver for the Glucose Tolerance Test Market. As healthcare systems evolve, there is a growing emphasis on preventing diseases rather than merely treating them. This trend is particularly evident in the management of diabetes, where early detection through glucose tolerance testing can lead to better health outcomes. The market is witnessing an increase in demand for preventive measures, with healthcare providers advocating for routine testing among at-risk populations. According to recent studies, early intervention can reduce the incidence of diabetes-related complications, thereby driving the Glucose Tolerance Test Market forward as more individuals seek preventive testing.

Technological Innovations in Testing Methods

Technological innovations are reshaping the landscape of the Glucose Tolerance Test Market. Advancements in testing methods, such as the development of non-invasive glucose monitoring devices, are enhancing the accuracy and convenience of glucose tolerance testing. These innovations not only improve patient compliance but also facilitate more frequent testing, which is crucial for effective diabetes management. The integration of technology into testing protocols is likely to attract a broader audience, including those who may have previously avoided traditional testing methods. As a result, the Glucose Tolerance Test Market stands to gain from these technological advancements, which are expected to drive growth in the coming years.