Rising Demand for Processed Foods

The food acidulants market is experiencing a notable increase in demand due to the growing consumption of processed foods in the US. As consumers seek convenience, the use of acidulants in products such as sauces, dressings, and snacks has surged. According to industry reports, the processed food sector is projected to grow at a CAGR of approximately 4.5% over the next five years. This trend is likely to drive the food acidulants market, as manufacturers incorporate these ingredients to enhance flavor, preserve freshness, and improve shelf life. The versatility of acidulants in various applications makes them indispensable in the formulation of processed foods, thereby contributing to the overall growth of the food acidulants market.

Health Conscious Consumer Behavior

There is a discernible shift in consumer preferences towards healthier food options, which is influencing the food acidulants market. As individuals become more health-conscious, they are increasingly scrutinizing ingredient labels, leading to a demand for acidulants that offer health benefits. For instance, citric acid is favored for its antioxidant properties, while lactic acid is recognized for its probiotic benefits. This trend is reflected in the market, where the demand for natural and organic acidulants is on the rise, accounting for nearly 30% of the total market share. The food acidulants market is thus adapting to these changing consumer behaviors by offering products that align with health trends.

Regulatory Support for Food Safety

The food acidulants market is benefiting from increased regulatory support aimed at ensuring food safety in the US. Regulatory bodies such as the FDA have established guidelines that promote the safe use of acidulants in food products. This regulatory framework not only enhances consumer confidence but also encourages manufacturers to incorporate acidulants that comply with safety standards. As a result, the food acidulants market is likely to see a rise in the adoption of approved acidulants, which can lead to improved product quality and safety. The emphasis on food safety is expected to drive market growth, as consumers prioritize products that meet stringent safety regulations.

Emerging Trends in Flavor Enhancement

The food acidulants market is witnessing a surge in demand driven by emerging trends in flavor enhancement. As culinary preferences evolve, consumers are increasingly seeking bold and unique flavors in their food products. Acidulants play a crucial role in flavor modulation, providing a balance of acidity that enhances taste profiles. This trend is particularly evident in the beverage sector, where acidulants are used to create refreshing and tangy flavors. The food acidulants market is thus positioned to capitalize on this trend, with manufacturers exploring innovative applications of acidulants to meet consumer expectations for flavor diversity. This could potentially lead to a market expansion as new flavor combinations are developed.

Technological Advancements in Food Processing

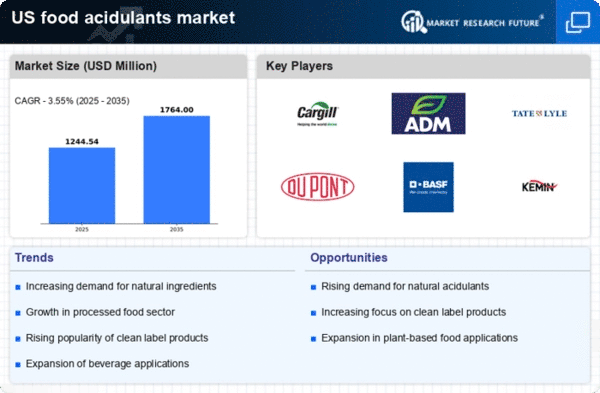

Technological innovations in food processing are significantly impacting the food acidulants market. Advanced techniques such as high-pressure processing and microencapsulation are being employed to enhance the efficacy of acidulants in food products. These technologies not only improve the stability and effectiveness of acidulants but also allow for their use in a wider range of applications. The integration of such technologies is expected to propel the food acidulants market, as manufacturers seek to optimize product formulations. Furthermore, the market is projected to reach a valuation of approximately $1.5 billion by 2027, indicating a robust growth trajectory driven by these advancements in food processing.