Supportive Regulatory Framework

The US Feed Phytobiotics Market benefits from a supportive regulatory framework that encourages the use of natural feed additives. Regulatory bodies, such as the Food and Drug Administration (FDA) and the Association of American Feed Control Officials (AAFCO), have established guidelines that facilitate the approval and use of phytobiotic products in animal feed. This regulatory support not only ensures the safety and efficacy of these products but also fosters consumer confidence in their use. As regulations continue to evolve, the market for phytobiotics is likely to expand, with more producers seeking to incorporate these natural additives into their feed formulations. The favorable regulatory environment is expected to be a significant driver for the growth of the US Feed Phytobiotics Market in the near future.

Increasing Demand for Sustainable Animal Feed

The US Feed Phytobiotics Market is experiencing a notable surge in demand for sustainable animal feed solutions. This trend is largely driven by the growing consumer preference for organic and natural products, which has prompted livestock producers to seek alternatives to conventional feed additives. According to recent data, the market for organic animal feed in the United States is projected to reach approximately USD 1.5 billion by 2026. Phytobiotics, derived from plant sources, offer a sustainable option that aligns with these consumer preferences. As a result, the adoption of phytobiotics is likely to increase, as they not only enhance animal health but also contribute to environmental sustainability. This shift towards sustainable practices is expected to bolster the growth of the US Feed Phytobiotics Market in the coming years.

Rising Awareness of Animal Health and Welfare

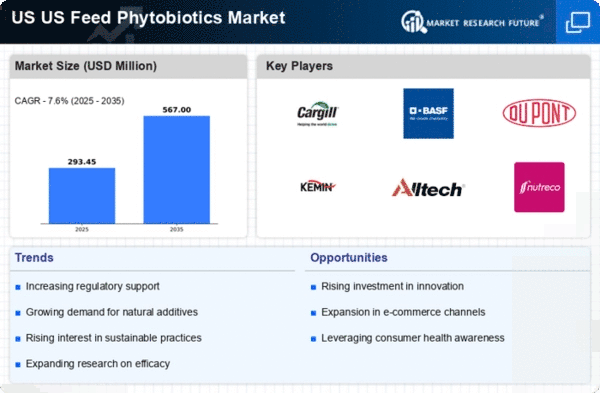

The US Feed Phytobiotics Market is significantly influenced by the rising awareness of animal health and welfare among consumers and producers alike. As the public becomes more informed about the benefits of natural feed additives, there is a growing inclination towards products that promote animal well-being. Phytobiotics, known for their ability to enhance gut health and improve overall immunity in livestock, are increasingly being recognized as essential components of animal nutrition. This heightened awareness is reflected in the increasing sales of phytobiotic products, which are projected to grow at a compound annual growth rate (CAGR) of around 8% through 2026. Consequently, the focus on animal health and welfare is likely to drive the demand for phytobiotics in the US Feed Phytobiotics Market, as producers strive to meet consumer expectations.

Growing Focus on Feed Efficiency and Productivity

The US Feed Phytobiotics Market is witnessing a growing focus on feed efficiency and productivity among livestock producers. As the demand for animal protein continues to rise, producers are increasingly seeking ways to optimize feed utilization and enhance growth rates in livestock. Phytobiotics have been shown to improve feed conversion ratios and overall productivity, making them an attractive option for producers aiming to maximize their output. Recent studies indicate that the incorporation of phytobiotics can lead to a 5-10% improvement in feed efficiency. This potential for enhanced productivity is likely to drive the adoption of phytobiotics in the US Feed Phytobiotics Market, as producers strive to meet the increasing global demand for animal products.

Technological Innovations in Phytobiotic Formulations

Technological advancements in the formulation of phytobiotics are playing a crucial role in shaping the US Feed Phytobiotics Market. Innovations such as encapsulation techniques and the development of targeted delivery systems are enhancing the efficacy of phytobiotic products. These advancements allow for better absorption and utilization of active compounds, thereby maximizing their benefits for livestock. As a result, producers are increasingly adopting these innovative formulations to improve animal performance and health. The market for feed additives, including phytobiotics, is expected to witness a growth trajectory, with estimates suggesting a valuation of USD 1.2 billion by 2026. This trend indicates that technological innovations are likely to be a key driver in the expansion of the US Feed Phytobiotics Market.