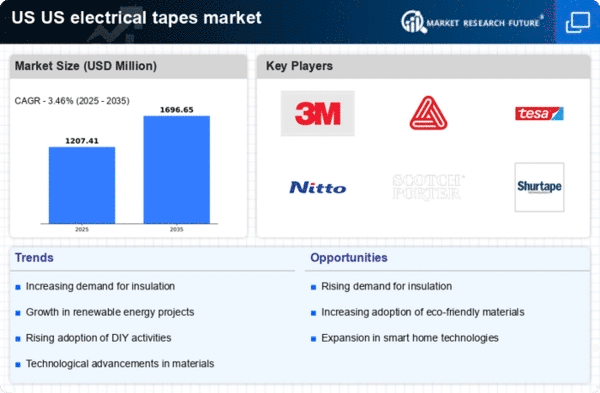

The electrical tapes market exhibits a dynamic competitive landscape characterized by innovation and strategic partnerships. Key players such as 3M (US), Avery Dennison (US), and tesa SE (DE) are at the forefront, leveraging their extensive product portfolios and technological advancements to capture market share. 3M (US) focuses on innovation, particularly in developing high-performance electrical tapes that cater to diverse industrial applications. Meanwhile, Avery Dennison (US) emphasizes sustainability, integrating eco-friendly materials into its product lines, which resonates with the growing demand for environmentally responsible solutions. tesa SE (DE) adopts a strategy of regional expansion, enhancing its distribution networks to penetrate emerging markets, thereby shaping the competitive environment through a blend of innovation and market accessibility.The business tactics employed by these companies include localizing manufacturing and optimizing supply chains to enhance efficiency and reduce costs. The market structure appears moderately fragmented, with several players competing for dominance. However, the collective influence of major companies like 3M (US) and Avery Dennison (US) suggests a trend towards consolidation, as these firms seek to leverage their strengths to outpace smaller competitors.

In October 3M (US) announced a significant investment in a new manufacturing facility aimed at increasing production capacity for its electrical tapes. This strategic move is likely to enhance 3M's ability to meet rising demand while also reducing lead times, thereby solidifying its market position. The investment underscores the company's commitment to innovation and operational efficiency, which are critical in maintaining competitive advantage.

In September Avery Dennison (US) launched a new line of sustainable electrical tapes made from recycled materials. This initiative not only aligns with global sustainability trends but also positions the company as a leader in eco-friendly solutions within the electrical tapes market. The launch reflects a broader industry shift towards sustainability, which is becoming increasingly important to consumers and businesses alike.

In August tesa SE (DE) entered into a strategic partnership with a leading automotive manufacturer to develop specialized electrical tapes for electric vehicles. This collaboration is indicative of the growing demand for high-performance materials in the automotive sector, particularly as the industry shifts towards electrification. By aligning with key players in the automotive space, tesa SE is likely to enhance its market presence and drive innovation in product development.

As of November current trends in the electrical tapes market are increasingly defined by digitalization, sustainability, and the integration of advanced technologies such as AI. Strategic alliances are shaping the competitive landscape, enabling companies to pool resources and expertise to drive innovation. The shift from price-based competition to a focus on technological advancement and supply chain reliability is evident, suggesting that future competitive differentiation will hinge on the ability to innovate and respond to evolving market demands.