US Edible Films Coatings Market Summary

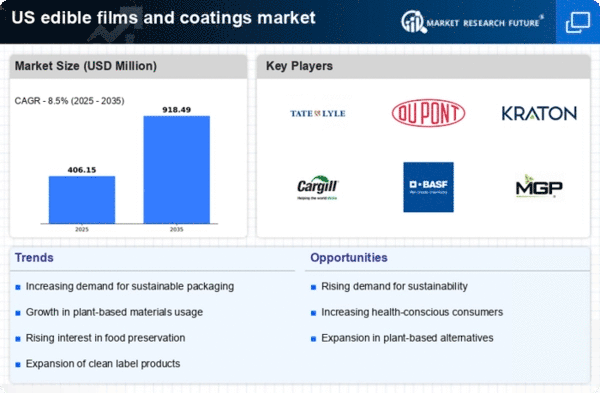

As per Market Research Future analysis, the US edible films and coatings market size was estimated at 374.33 USD Million in 2024. The US edible films-coatings market is projected to grow from 406.15 USD Million in 2025 to 918.49 USD Million by 2035, exhibiting a compound annual growth rate (CAGR) of 8% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The US edible films-coatings market is experiencing a transformative shift towards sustainability and health-conscious innovations.

- The market is witnessing a growing emphasis on sustainability, with consumers increasingly favoring eco-friendly packaging solutions.

- Health-conscious innovations are driving the development of edible films and coatings that enhance food safety and nutritional value.

- Technological advancements are facilitating the creation of more effective and versatile edible films, particularly in the largest segment of food packaging.

- Rising demand for natural ingredients and consumer awareness of food waste are key drivers propelling market growth.

Market Size & Forecast

| 2024 Market Size | 374.33 (USD Million) |

| 2035 Market Size | 918.49 (USD Million) |

| CAGR (2025 - 2035) | 8.5% |

Major Players

Tate & Lyle (GB), DuPont (US), Kraton Corporation (US), Cargill (US), BASF (DE), MGP Ingredients (US), Ingredion (US), Mitsubishi Chemical (JP), NatureWorks (US)