Rising Demand for Plant-Based Oils

The increasing consumer preference for plant-based diets is driving the demand for oils derived from sources such as soybeans, sunflowers, and canola. This trend is particularly evident in regions where health-conscious choices are becoming more prevalent. In the edible oils and fats market, plant-based oils are projected to account for a significant share, with estimates suggesting that their consumption could rise by over 20% in the next five years. This shift is influenced by the growing awareness of the health benefits associated with these oils, including lower saturated fat content and higher levels of essential fatty acids. As consumers seek healthier alternatives, the market for plant-based oils is likely to expand, prompting manufacturers to innovate and diversify their product offerings.

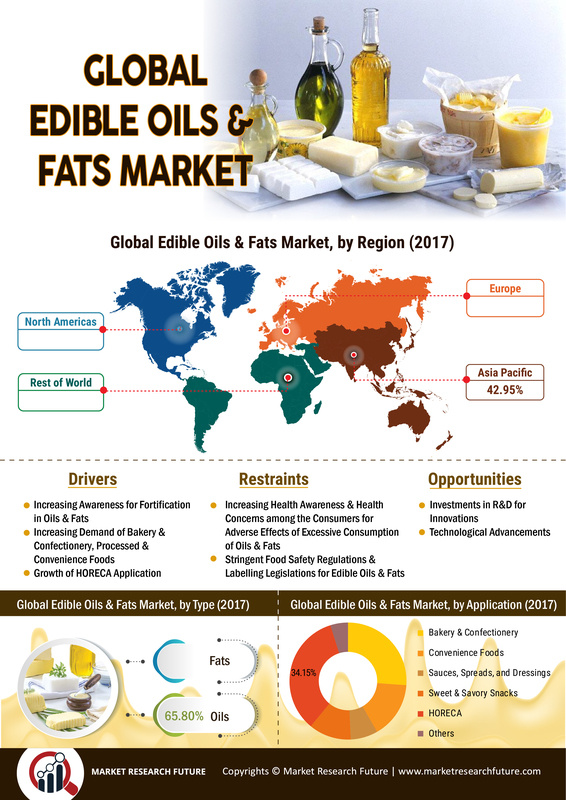

Expansion of the Food Service Sector

The food service industry, encompassing restaurants, cafes, and catering services, is a significant driver of the edible oils and fats market. As dining out becomes increasingly popular, the demand for various cooking oils is expected to rise. The Global Edible Oils and Fats industry is likely to benefit from this trend, with estimates suggesting that the food service sector could contribute to a substantial portion of overall oil consumption. This growth is fueled by the rising number of food establishments and the diversification of cuisines offered, which often require specific types of oils for authentic flavor profiles. Furthermore, the trend towards healthier cooking practices in food service establishments is prompting chefs to seek high-quality oils, thereby influencing purchasing decisions and market dynamics.

Growing Awareness of Health Benefits

Consumer awareness regarding the health implications of dietary fats is influencing purchasing behavior in the edible oils and fats market. As individuals become more informed about the nutritional profiles of different oils, there is a noticeable shift towards healthier options, such as olive oil and avocado oil. This trend is reflected in market data, which indicates that sales of these oils have increased significantly, with olive oil alone witnessing a growth rate of approximately 6% annually. The emphasis on heart-healthy fats and the reduction of trans fats in diets are driving consumers to opt for oils that offer health benefits. Consequently, manufacturers are responding by enhancing their product lines to include oils that cater to this health-conscious demographic, thereby shaping the future landscape of the market.

Sustainability Initiatives in Oil Production

Sustainability has emerged as a critical factor in the production of edible oils and fats, influencing both consumer preferences and industry practices. The Global Edible Oils and Fats industry is witnessing a shift towards sustainable sourcing and production methods, driven by increasing environmental concerns. Many consumers are now seeking products that are certified as sustainable, prompting manufacturers to adopt practices that minimize environmental impact. This includes the use of eco-friendly farming techniques and responsible sourcing of raw materials. Market data suggests that the demand for sustainably produced oils is on the rise, with projections indicating that this segment could grow by over 15% in the coming years. As sustainability becomes a key differentiator in the market, companies that prioritize eco-friendly practices are likely to gain a competitive edge.

Increased Use of Edible Oils in Food Processing

The food processing sector is a major consumer of edible oils and fats Market, utilizing them in various applications such as frying, baking, and as ingredients in processed foods. The Global Edible Oils and Fats industry is experiencing a surge in demand from this sector, with projections indicating a compound annual growth rate of approximately 4% over the next few years. This growth is attributed to the rising consumption of convenience foods and ready-to-eat meals, which often require the use of oils for flavor enhancement and preservation. Additionally, the trend towards healthier cooking oils is influencing food manufacturers to reformulate their products, thereby increasing the demand for high-quality edible oils. As the food processing industry evolves, the need for diverse oil options is expected to grow, further driving market expansion.