Rising Generic Drug Market

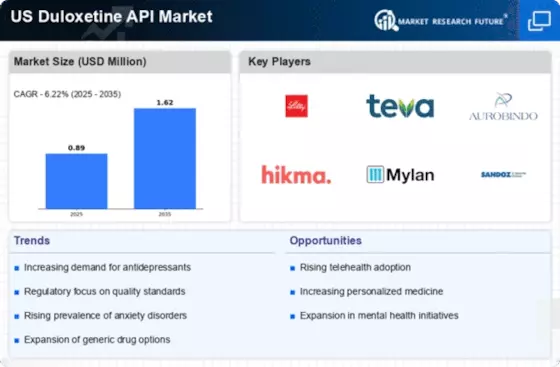

The US Duloxetine Api Market is significantly influenced by the expansion of the generic drug market. With the patent for Duloxetine expiring, numerous generic manufacturers have entered the market, leading to increased availability and reduced prices for consumers. According to the FDA, generic drugs account for approximately 90% of all prescriptions filled in the US, highlighting the shift towards cost-effective treatment options. This trend is particularly relevant in the context of Duloxetine, as patients and healthcare providers increasingly prefer generics due to their affordability. The rise of generics not only enhances patient access to essential medications but also stimulates competition among manufacturers, thereby driving growth in the US Duloxetine Api Market.

Expansion of Telehealth Services

The US Duloxetine Api Market is likely to benefit from the ongoing expansion of telehealth services. The convenience and accessibility of telehealth have made it easier for patients to consult with healthcare providers regarding mental health issues. This trend has led to an increase in prescriptions for medications like Duloxetine, as patients can receive timely evaluations and treatment recommendations from the comfort of their homes. According to a report from the American Telemedicine Association, telehealth usage has surged, with many patients reporting positive experiences. As telehealth continues to gain traction, it is expected to drive demand for Duloxetine APIs, thereby contributing to the growth of the US Duloxetine Api Market.

Growing Focus on Personalized Medicine

The US Duloxetine Api Market is poised for growth as the healthcare sector increasingly emphasizes personalized medicine. This approach tailors treatment plans to individual patient needs, which is particularly relevant for mental health conditions where responses to medications can vary significantly. As healthcare providers adopt more personalized treatment strategies, the demand for Duloxetine APIs may increase, as this medication is often part of a broader therapeutic regimen. Additionally, advancements in pharmacogenomics are enabling clinicians to better predict patient responses to Duloxetine, further driving its utilization. The shift towards personalized medicine represents a significant opportunity for the US Duloxetine Api Market to expand and adapt to evolving patient needs.

Regulatory Support for Mental Health Medications

The US Duloxetine Api Market benefits from favorable regulatory support aimed at enhancing access to mental health medications. The Food and Drug Administration (FDA) has streamlined the approval process for new formulations and generics of Duloxetine, which encourages pharmaceutical companies to invest in research and development. This regulatory environment not only facilitates the introduction of innovative products but also ensures that existing medications remain accessible to patients. As a result, the market is likely to see an influx of new entrants and increased competition, which could lead to more affordable options for consumers. The ongoing support from regulatory bodies is a crucial driver for the growth of the US Duloxetine Api Market.

Increasing Prevalence of Depression and Anxiety Disorders

The US Duloxetine Api Market is experiencing growth due to the rising prevalence of depression and anxiety disorders among the population. According to the National Institute of Mental Health, approximately 19.1% of adults in the US experienced mental illness in 2020, a figure that has likely increased in recent years. This growing patient population necessitates effective treatment options, with Duloxetine being a preferred choice due to its dual-action mechanism. As healthcare providers seek to address these mental health challenges, the demand for Duloxetine APIs is expected to rise, driving market expansion. Furthermore, the increasing awareness of mental health issues is prompting more individuals to seek treatment, further contributing to the growth of the US Duloxetine Api Market.