Market Growth Projections

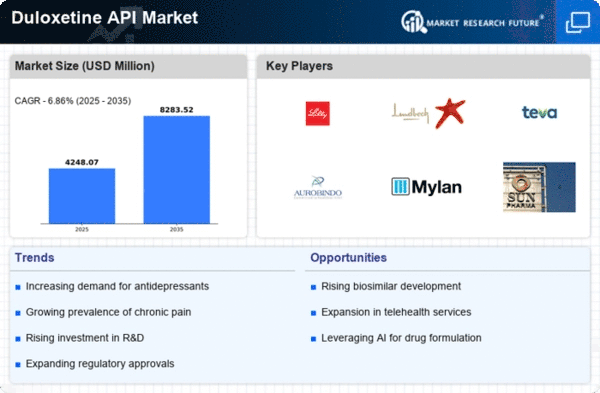

The Global Duloxetine API Market Industry is projected to experience substantial growth over the next decade. With an estimated value of 3.42 USD Billion in 2024, the market is expected to reach 5.39 USD Billion by 2035, reflecting a CAGR of 4.22% from 2025 to 2035. This growth is indicative of the increasing demand for Duloxetine, driven by factors such as rising mental health awareness and expanding therapeutic applications. The market's trajectory suggests a robust future, with opportunities for innovation and development within the pharmaceutical sector.

Growing Generic Drug Market

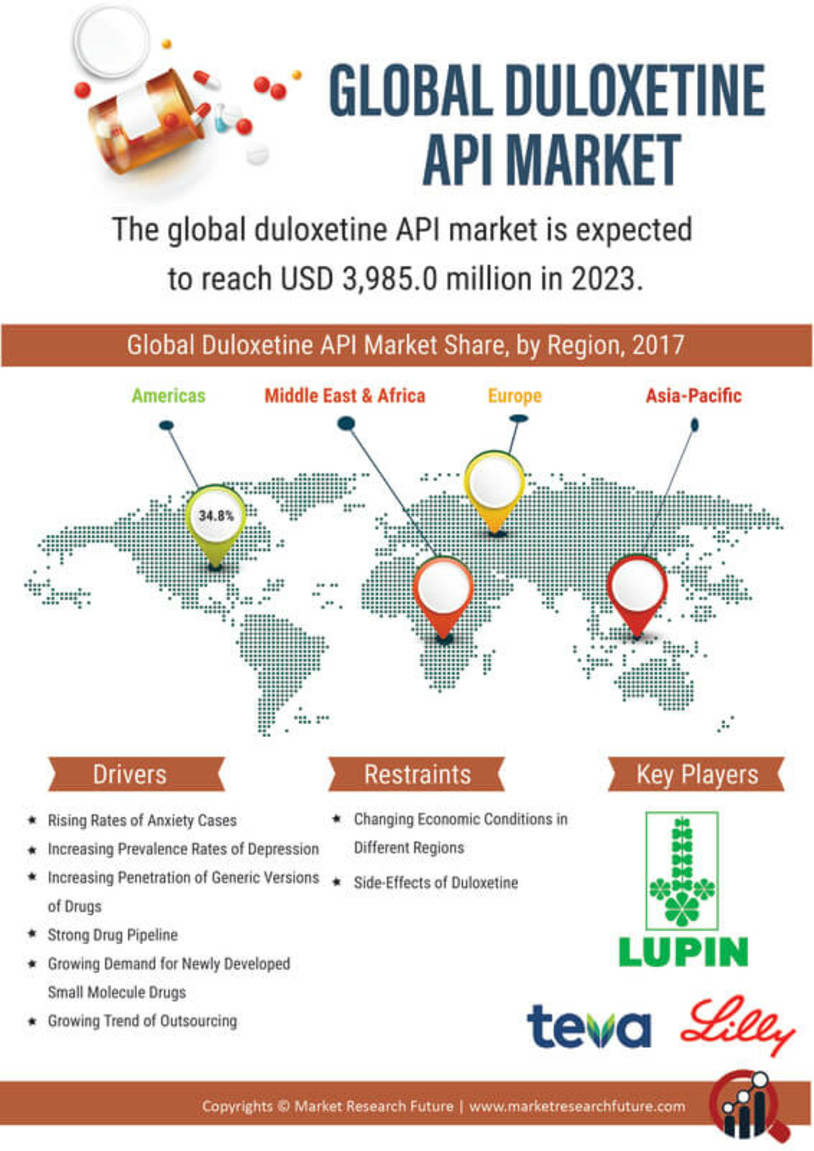

The rise of the generic drug market is a significant driver for the Global Duloxetine API Market Industry. As patents for branded medications expire, generic versions of Duloxetine become available, increasing accessibility for patients and healthcare providers. This trend is expected to contribute to market growth, as generics typically offer cost-effective alternatives without compromising efficacy. The anticipated growth trajectory from 3.42 USD Billion in 2024 to 5.39 USD Billion by 2035 underscores the potential impact of generics on the market. The availability of affordable Duloxetine options may enhance treatment adherence among patients.

Expanding Therapeutic Applications

Duloxetine is not only utilized for depression and anxiety but also for chronic pain management, including diabetic neuropathy and fibromyalgia. This broadening of therapeutic applications enhances the Global Duloxetine API Market Industry's growth potential. As healthcare providers increasingly recognize the efficacy of Duloxetine in treating various conditions, the market is likely to expand. The projected growth from 3.42 USD Billion in 2024 to 5.39 USD Billion by 2035 indicates a robust demand trajectory. The versatility of Duloxetine positions it as a key player in the pharmaceutical landscape, catering to diverse patient needs.

Advancements in Pharmaceutical Manufacturing

Technological advancements in pharmaceutical manufacturing processes are poised to enhance the production efficiency of Duloxetine API. Innovations such as continuous manufacturing and process optimization can potentially reduce production costs and improve product quality. This efficiency is critical for the Global Duloxetine API Market Industry, as it allows manufacturers to meet rising demand while maintaining competitive pricing. As the market grows, with a projected CAGR of 4.22% from 2025 to 2035, these advancements may facilitate increased output and accessibility of Duloxetine, thereby benefiting patients and healthcare systems alike.

Rising Prevalence of Mental Health Disorders

The increasing incidence of mental health disorders globally drives the demand for Duloxetine API. Conditions such as major depressive disorder and generalized anxiety disorder are becoming more prevalent, necessitating effective treatment options. In 2024, the Global Duloxetine API Market Industry is projected to reach 3.42 USD Billion, reflecting the growing need for antidepressants. This trend is likely to continue as awareness of mental health issues expands, leading to higher diagnosis rates and treatment uptake. The Global Duloxetine API Market Industry is expected to play a crucial role in addressing these mental health challenges.

Regulatory Support for Mental Health Treatments

Regulatory bodies are increasingly supportive of mental health treatments, which positively influences the Global Duloxetine API Market Industry. Initiatives aimed at improving access to mental health care and streamlining drug approval processes contribute to a favorable environment for Duloxetine. As governments recognize the importance of mental health, policies encouraging the development and distribution of effective medications are likely to emerge. This regulatory support may lead to increased market penetration and growth, further solidifying Duloxetine's position in the therapeutic landscape.