Emergence of Synthetic Genomics

The emergence of synthetic genomics is reshaping the landscape of the DNA Synthesis Market, as it focuses on the design and construction of entire genomes. This innovative approach has the potential to revolutionize various industries, including healthcare, energy, and materials. The synthetic genomics market is anticipated to grow significantly, with estimates suggesting a value of $5 billion by 2028 in the US. This growth is driven by the increasing interest in creating custom organisms for specific applications, which necessitates advanced dna synthesis capabilities. As research in synthetic genomics progresses, the dna synthesis market is likely to expand, providing new opportunities for companies involved in this cutting-edge field.

Advancements in Synthetic Biology

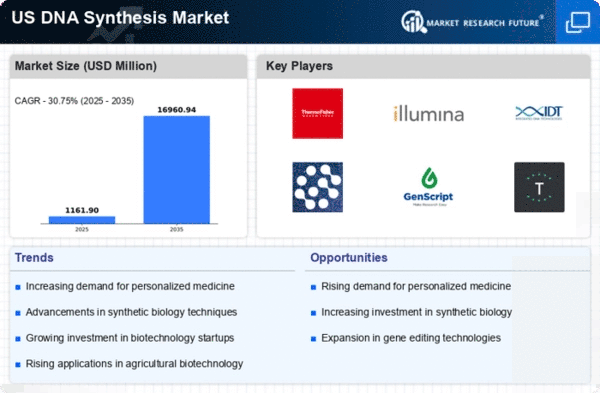

The DNA Synthesis Market is experiencing a surge due to advancements in synthetic biology, which enables the design and construction of new biological parts and systems. This field has seen substantial investment, with funding reaching approximately $1.5 billion in the US in recent years. These innovations facilitate the development of novel therapeutics, biofuels, and agricultural products, thereby expanding the applications of dna synthesis. As researchers continue to explore the potential of synthetic biology, the demand for high-quality, cost-effective dna synthesis services is likely to increase. This trend indicates a robust growth trajectory for the dna synthesis market, as companies strive to meet the evolving needs of the biotechnology sector.

Growing Demand for Gene Therapies

The increasing prevalence of genetic disorders and the rising interest in gene therapies are driving the DNA Synthesis Market. In the US, the gene therapy market is projected to reach $10 billion by 2026, reflecting a compound annual growth rate (CAGR) of over 30%. This growth is fueled by the need for innovative treatment options that address previously untreatable conditions. As gene therapies rely heavily on precise dna synthesis for the development of therapeutic agents, the market is poised for expansion. The collaboration between pharmaceutical companies and dna synthesis providers is likely to enhance the efficiency and effectiveness of gene therapy development, further propelling the dna synthesis market.

Rising Applications in Agriculture

The application of dna synthesis in agriculture is becoming increasingly prominent, driven by the need for sustainable farming practices and food security. The market for genetically modified organisms (GMOs) is projected to reach $40 billion by 2027 in the US, indicating a significant opportunity for dna synthesis providers. These applications include the development of crops with enhanced traits such as pest resistance and improved nutritional content. As agricultural biotechnology continues to evolve, the DNA Synthesis Market is expected to benefit from the demand for innovative solutions that address global food challenges. This trend suggests a promising future for the dna synthesis market as it aligns with the agricultural sector's goals.

Increased Investment in Biotechnology

Investment in biotechnology is a key driver of the DNA Synthesis Market, as funding for biotech startups and established companies continues to rise. In 2025, venture capital investments in the US biotech sector are expected to exceed $20 billion, highlighting the growing confidence in the industry's potential. This influx of capital supports research and development activities, particularly in areas such as genomics and personalized medicine, which rely on advanced dna synthesis techniques. As biotechnology firms seek to innovate and bring new products to market, the demand for dna synthesis services is likely to grow, thereby strengthening the overall market.