Growing Biopharmaceutical Sector

The biopharmaceutical sector in South America is experiencing substantial growth, which is significantly impacting the DNA synthesis market. With an increasing number of biopharmaceutical companies focusing on developing novel therapies, the demand for custom DNA synthesis is on the rise. In 2025, the biopharmaceutical market in South America is expected to reach approximately $50 billion, indicating a robust growth trajectory. This surge is driven by the need for personalized medicine and targeted therapies, which rely heavily on synthetic DNA. Consequently, the DNA synthesis market is likely to benefit from partnerships and collaborations between biopharmaceutical firms and DNA synthesis providers, enhancing innovation and product offerings.

Rising Awareness of Genetic Research

The growing awareness of genetic research among the South American population is influencing the DNA synthesis market. As educational institutions and research organizations emphasize the importance of genetics in health and agriculture, there is an increasing interest in synthetic biology applications. This heightened awareness is likely to lead to a greater demand for DNA synthesis services, as researchers seek to explore genetic modifications and innovations. Furthermore, public interest in genetic testing and personalized medicine is expected to drive market growth. The DNA synthesis market may see a rise in collaborations between academic institutions and commercial entities, fostering a culture of innovation and research in the region.

Emerging Startups in Synthetic Biology

The emergence of startups focused on synthetic biology in South America is a dynamic driver for the DNA synthesis market. These startups are often agile and innovative, bringing fresh ideas and technologies to the market. Many are concentrating on developing cost-effective and efficient DNA synthesis solutions, which could disrupt traditional methods. The startup ecosystem is thriving, with an estimated 150 new companies entering the biotechnology space in the past year alone. This influx of new players is likely to stimulate competition and drive advancements in DNA synthesis technologies. As these startups collaborate with established firms and research institutions, the DNA synthesis market is poised for significant growth and transformation.

Technological Advancements in DNA Synthesis

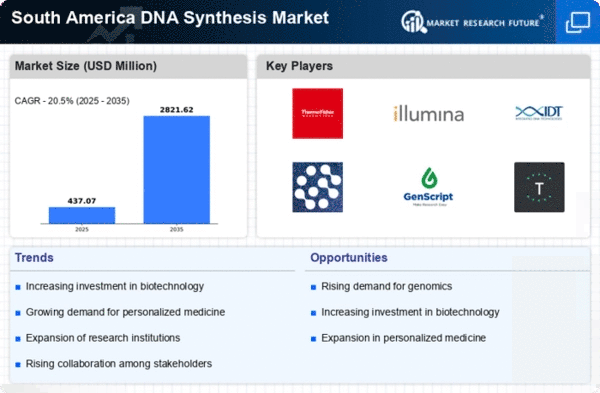

The rapid evolution of technology in the DNA synthesis market is a pivotal driver in South America. Innovations such as next-generation sequencing and CRISPR technology are enhancing the efficiency and accuracy of DNA synthesis processes. These advancements are likely to reduce costs, making synthetic biology more accessible to researchers and companies. As a result, the market is projected to grow at a CAGR of approximately 15% over the next five years. This growth is fueled by the increasing application of synthetic DNA in pharmaceuticals, agriculture, and biotechnology, which are critical sectors in South America. The integration of automation and artificial intelligence in DNA synthesis workflows further streamlines operations, potentially increasing throughput and reducing turnaround times.

Increased Funding for Biotechnology Initiatives

In South America, there is a notable increase in funding directed towards biotechnology initiatives, which serves as a significant driver for the DNA synthesis market. Governments and private investors are recognizing the potential of biotechnology to address health and agricultural challenges. For instance, funding for biotechnology research has increased by over 20% in recent years, facilitating advancements in DNA synthesis technologies. This influx of capital is likely to support the development of new applications in synthetic biology, including gene editing and synthetic vaccines. As a result, the DNA synthesis market is expected to expand, driven by the growing number of projects and research initiatives aimed at leveraging synthetic DNA for innovative solutions.