Emergence of IoT Applications

The digital signal-processors-dsp market is poised for growth due to the emergence of Internet of Things (IoT) applications. As more devices become interconnected, the need for efficient data processing and real-time analytics is becoming increasingly critical. The IoT market is projected to reach $1 trillion by 2026, with a significant portion relying on DSP technology for data acquisition and processing. This trend suggests that DSPs will play a vital role in enabling smart homes, industrial automation, and smart cities. The ability of DSPs to handle large volumes of data with low power consumption makes them ideal for IoT applications, thereby driving their adoption in various sectors. Consequently, the digital signal-processors-dsp market is likely to expand as IoT continues to gain traction.

Growing Focus on Smart Manufacturing

The digital signal-processors-dsp market is being driven by a growing focus on smart manufacturing practices. As industries adopt automation and data-driven decision-making, the demand for advanced signal processing solutions is increasing. Smart manufacturing is projected to contribute approximately $500 billion to the economy by 2026, with DSPs playing a crucial role in optimizing production processes. These processors enable real-time monitoring and control of machinery, enhancing efficiency and reducing downtime. The integration of DSP technology in manufacturing systems allows for improved data analysis and predictive maintenance, which are essential for maintaining competitive advantage. Therefore, the digital signal-processors-dsp market is likely to see substantial growth as smart manufacturing continues to evolve.

Increased Adoption of Consumer Electronics

The digital signal-processors-dsp market is significantly influenced by the rising adoption of consumer electronics, which is driving innovation and demand for high-quality audio and video processing. With the proliferation of smart devices, including smartphones, tablets, and smart TVs, the need for efficient DSPs has become paramount. The market for consumer electronics is expected to reach approximately $400 billion by 2026, with a substantial portion allocated to advanced signal processing technologies. This trend indicates a growing consumer preference for devices that offer superior sound and image quality, which in turn propels the demand for advanced DSP solutions. As manufacturers strive to meet these consumer expectations, the digital signal-processors-dsp market is likely to see continued growth and innovation.

Technological Advancements in Signal Processing

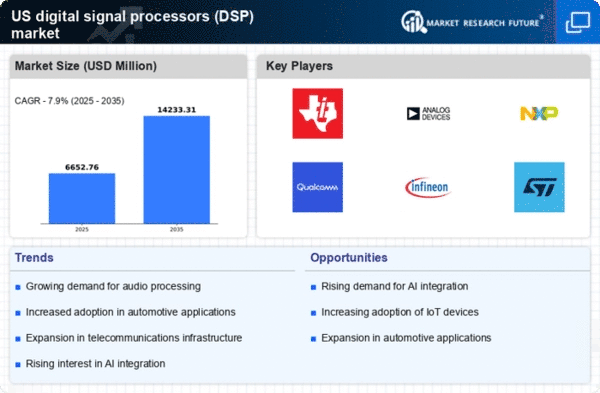

Technological advancements in signal processing are significantly impacting the digital signal-processors-dsp market. Innovations in algorithms and hardware design are enabling DSPs to perform more complex tasks with greater efficiency. For instance, the integration of parallel processing capabilities allows for faster data handling, which is essential in applications such as real-time audio and video processing. The market is expected to witness a growth rate of around 7% annually as these advancements continue to evolve. Furthermore, the development of specialized DSP architectures tailored for specific applications, such as automotive and healthcare, is likely to enhance performance and broaden the market's scope. Thus, the digital signal-processors-dsp market is set to benefit from ongoing technological progress.

Rising Demand for Advanced Communication Systems

The digital signal-processors-dsp market is experiencing a notable surge in demand driven by the increasing need for advanced communication systems. As industries such as telecommunications and broadcasting evolve, the requirement for high-performance DSPs becomes critical. The market is projected to grow at a CAGR of approximately 8% over the next five years, reflecting the necessity for enhanced data processing capabilities. This growth is largely attributed to the proliferation of 5G technology, which necessitates sophisticated signal processing to manage higher data rates and lower latency. Consequently, manufacturers are focusing on developing DSPs that can efficiently handle complex algorithms, thereby ensuring seamless communication. The digital signal-processors-dsp market is thus positioned to benefit significantly from these advancements in communication technology.