Advancements in Cloud Technologies

The US Digital Process Automation Market is significantly influenced by advancements in cloud technologies. The shift towards cloud-based solutions allows organizations to deploy automation tools more flexibly and cost-effectively. As of January 2026, approximately 70% of businesses in the US are utilizing cloud services for their automation needs. This trend not only reduces the upfront costs associated with traditional IT infrastructure but also enhances scalability and accessibility. Consequently, the proliferation of cloud technologies is expected to propel the growth of the US Digital Process Automation Market, as more organizations seek to leverage these benefits.

Integration of Emerging Technologies

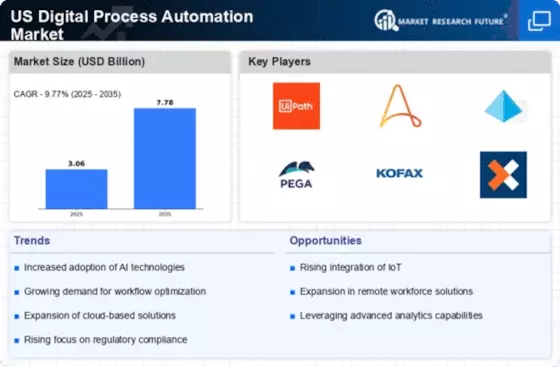

The US Digital Process Automation Market is witnessing a trend towards the integration of emerging technologies such as artificial intelligence and machine learning. These technologies enhance the capabilities of automation tools, enabling organizations to analyze data more effectively and make informed decisions. As of January 2026, it is estimated that over 50% of automation solutions in the US incorporate some form of AI or machine learning. This integration not only improves process efficiency but also allows for predictive analytics, which can further optimize operations. The increasing adoption of these technologies is poised to drive substantial growth in the US Digital Process Automation Market.

Increased Focus on Customer Experience

In the US Digital Process Automation Market, there is a growing emphasis on enhancing customer experience. Organizations are leveraging automation tools to improve service delivery and responsiveness. By automating customer interactions and support processes, companies can provide faster and more personalized services. Data indicates that businesses that prioritize customer experience through automation can see a 20% increase in customer satisfaction scores. This focus on customer-centric automation is reshaping how companies engage with their clients, making it a critical driver for growth in the US Digital Process Automation Market.

Rising Demand for Operational Efficiency

The US Digital Process Automation Market is experiencing a notable surge in demand for operational efficiency. Organizations across various sectors are increasingly adopting automation technologies to streamline their processes, reduce operational costs, and enhance productivity. According to recent data, companies that implement digital process automation can achieve up to a 30% reduction in operational costs. This trend is particularly evident in industries such as manufacturing and finance, where efficiency gains translate directly into competitive advantages. As businesses strive to remain agile and responsive to market changes, the push for automation is likely to continue, driving growth in the US Digital Process Automation Market.

Regulatory Compliance and Risk Management

The US Digital Process Automation Market is increasingly driven by the need for regulatory compliance and effective risk management. As regulations become more stringent across various sectors, organizations are turning to automation to ensure compliance and mitigate risks. Automation tools can streamline compliance processes, reduce human error, and provide real-time reporting capabilities. In fact, studies suggest that companies utilizing automation for compliance can reduce the time spent on regulatory reporting by up to 40%. This growing necessity for compliance-driven automation is likely to bolster the US Digital Process Automation Market in the coming years.