Expansion of Cloud-Based Solutions

The proliferation of cloud computing is significantly influencing the data discovery market, as organizations transition to cloud-based solutions for enhanced flexibility and scalability. The cloud offers a cost-effective alternative to traditional on-premises systems, allowing businesses to access powerful data discovery tools without substantial upfront investments. Recent data suggests that The cloud segment of the data discovery market is expected to grow by over 25% annually, reflecting a shift in how organizations manage and analyze data. This trend indicates a growing preference for solutions that provide seamless integration with existing cloud infrastructures, thereby facilitating easier data access and collaboration across teams.

Rising Demand for Real-Time Insights

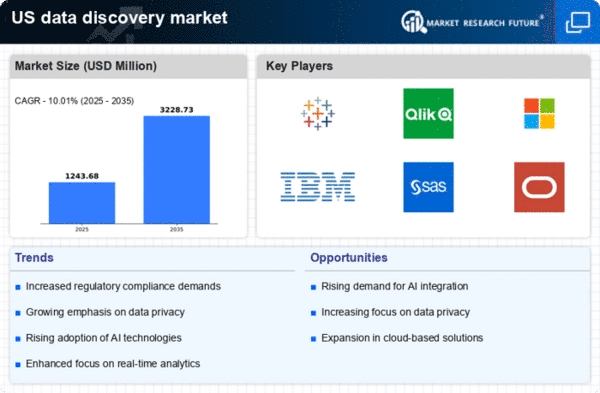

The data discovery market is experiencing a notable surge in demand for real-time insights, driven by organizations' need to make informed decisions swiftly. As businesses increasingly rely on data to guide their strategies, the ability to access and analyze data in real-time becomes paramount. According to recent estimates, the market for real-time analytics is projected to grow at a CAGR of approximately 30% over the next five years. This trend indicates a strong inclination towards tools that facilitate immediate data access and visualization, thereby enhancing operational efficiency. Consequently, the data discovery market is likely to expand as companies seek solutions that provide timely insights, enabling them to respond to market changes and customer needs more effectively.

Emergence of Advanced Analytics Techniques

The advent of advanced analytics techniques is reshaping the data discovery market, as organizations seek to derive deeper insights from their data. Techniques such as predictive analytics and data mining are gaining traction, enabling businesses to uncover patterns and trends that were previously obscured. This shift is reflected in a reported increase of 35% in the adoption of advanced analytics tools among enterprises in the last year. As organizations recognize the potential of these techniques to drive innovation and improve decision-making, the demand for data discovery solutions that incorporate advanced analytics capabilities is expected to rise. This trend suggests a transformative phase for the data discovery market, characterized by a focus on sophisticated analytical methodologies.

Increased Regulatory Compliance Requirements

The evolving landscape of regulatory compliance is a critical driver for the data discovery market. As organizations face heightened scrutiny regarding data privacy and security, the need for robust data governance frameworks becomes essential. Compliance with regulations such as the CCPA and GDPR necessitates advanced data discovery tools that can ensure data integrity and transparency. Recent surveys indicate that over 60% of companies are prioritizing investments in compliance-related technologies, which is likely to bolster the data discovery market. This trend highlights the importance of solutions that not only facilitate data analysis but also support compliance efforts, thereby enhancing organizational trust and accountability.

Growing Importance of Data-Driven Decision Making

In the current business landscape, the emphasis on data-driven decision making is reshaping the data discovery market. Organizations are increasingly recognizing the value of leveraging data to inform their strategies and operations. This shift is reflected in a reported increase of over 40% in companies adopting data analytics tools in the past year alone. As firms strive to enhance their competitive edge, the demand for data discovery solutions that enable comprehensive data analysis and visualization is expected to rise. This trend underscores the necessity for businesses to invest in technologies that facilitate data exploration and interpretation, thereby driving growth within the data discovery market.